Municipality

- Articles

- Municipality

Tax Burden in Falun Municipality

Falun Municipality, located in the heart of Dalarna, has a municipal tax rate of 22.06%, a county council tax of 11.64%, and a burial fee of 0.28%. For members of the Swedish Church, a church fee of 1.43% is added. The total tax burden excluding the church fee thus amounts to 33.7%.

Use of Tax Revenues

Tax revenues in Falun Municipality are used to finance a range of important services and functions. A large part of the budget goes to education, including preschools, primary schools, and upper secondary schools. Healthcare and social services are also significant items, with elderly care and support for people with disabilities being prioritized. Infrastructure, such as roads and public transport, as well as cultural and recreational activities, are other areas funded by tax revenues.

Economic Challenges and Opportunities

Falun Municipality faces several economic challenges. An aging population means increased costs for healthcare and social services, while there is a need to invest in education and infrastructure to attract and retain young families. The municipality is actively working to streamline operations and find new sources of income to meet these challenges.

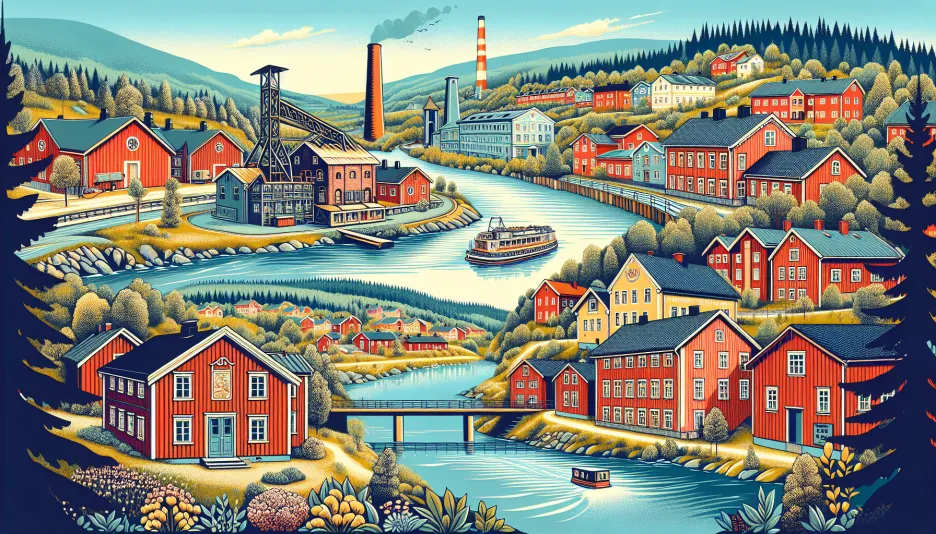

On the positive side, Falun has strong opportunities in tourism and culture. With the World Heritage Site of Falun Mine and a rich history, the municipality attracts many visitors each year. Additionally, there is a growing tech sector and several initiatives to support small businesses and innovation.

Standard of Living and Quality

Falun offers a high standard of living with good educational opportunities, access to healthcare and social services, and a wide range of recreational activities. The nature around Falun is a great asset, with proximity to both forests and lakes, contributing to a high quality of life for residents.

Impact on Individuals' Finances

The tax burden in Falun naturally affects how much money individuals have left in their wallets after paying taxes. With a total tax rate of 33.7% excluding the church fee, it can feel like a significant portion of income goes to taxes. For members of the Swedish Church, the total tax burden becomes 35.13%.

It is important for individuals to be aware of how taxes affect their finances and budget accordingly. To get a better understanding of how much is left after taxes, you can use our tax calculator, which calculates the net salary based on the gross salary entered.

In summary, Falun offers a high standard of living and good quality of municipal services, but also faces economic challenges that require careful planning and streamlining. The tax burden is an important factor for residents to consider, but it also contributes to funding the many services and functions that make Falun an attractive place to live.

Sweden's national debt

-

Opinion Poll: Demoskop February 2026 – Center increases, S still largest

Fri, 27 Feb 2026 - 09:35 -

Policy rate remains at 1.75% – Riksbank signals stability

Thu, 29 Jan 2026 - 14:02