Calculate Swedish Tax / Net Salary in Lysekil municipality

- Home

- Calculate Take-Home Pay, Net Salary

Lysekil Municipality – facts, statistics, and insights

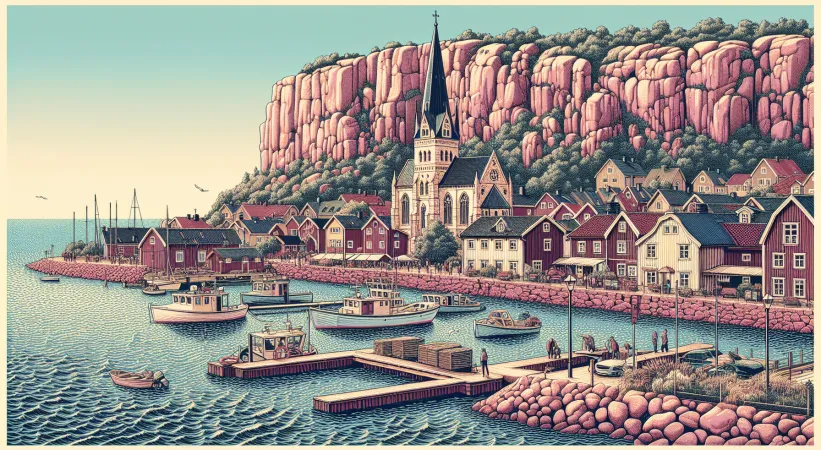

Lysekil municipality is a gem on the Bohuslän west coast, offering dramatic granite formations, salty breezes, and a vibrant coastal life. Both tourists and residents are drawn here for the closeness to the sea, small-town atmosphere, and a community where business and nature have a clear place. But Lysekil is also a municipality with interesting statistics on population, economy, and tax burden – and several unique features that make it worth a closer look.

Population and Demographics

Lysekil has long attracted people wanting to live near the sea, and the municipality has about 14,000 inhabitants. The population includes both permanent residents and a large number of holiday homes, especially in summer when the population increases significantly. An notable trend is the aging population, which impacts both service offerings and the labor market. At the same time, Lysekil has a strong tradition of community involvement and local engagement, fostering a sense of belonging even in a small municipality.

It is fascinating how Lysekil manages to combine the tranquility of a small town with an active summer life – and how the sea shapes both everyday life and the future of the municipality.

Taxes, Welfare, and Municipal Services

Lysekil has a municipal tax rate of 22.46%, which, together with the county council tax of 11.48%, results in a total tax burden of 33.94% (excluding church fee). For members of the Church of Sweden, an additional 1.37% church fee and 0.29% mandatory funeral fee are added. Tax revenues are used for schools, elder care, social services, and infrastructure. The municipality faces challenges with an aging population, which demands high standards for elder care and healthcare – but there is also a strong desire to maintain high service levels for all ages.

- Municipal tax: 22.46%

- County council tax: 11.48%

- Funeral fee: 0.29%

- Church fee: 1.37% (for members of the Church of Sweden)

Many appreciate the good access to schools, health centers, and leisure activities, while the distances are shorter compared to larger cities. The size of the municipality makes it easy to influence and engage in local issues.

Economy and Labor Market

Lysekil’s economy has traditionally relied on fishing, shipping, and industry, but today the business landscape is broader. Tourism is a key driver, especially during the summer months when restaurants, hotels, and activities flourish. Larger employers are found within industry and the public sector. Unemployment is close to the national average, but seasonal variations are significant – many jobs are tied to the summer months. The municipality actively works to develop the business sector year-round, including supporting companies and attracting new investments.

- Historically dominated by fishing and shipping

- Tourism and services are rapidly growing

- The public sector is a major employer

Education, Business, and Future Outlook

Educational opportunities in Lysekil are good for a smaller municipality, with several schools and adult education. Collaboration with the business sector is important, especially within maritime industries and environmental technology. The municipality aims to be attractive for young families and entrepreneurs, with a growing interest in sustainability and innovation. An interesting aspect is the collaboration with research institutes on marine environments and marine technology – giving Lysekil a unique position on the west coast.

Geography and Attractions

Lysekil is beautifully situated by Gullmarsfjorden and is known for its red granite cliffs, saltwater baths, and expansive views. The sea is never far away, and the archipelago attracts boaters and nature lovers. The town of Lysekil is charming with its classic architecture, but there are also small communities and picturesque fishing villages within the municipality. The Sea House, Stångehuvud Nature Reserve, and numerous beaches are popular destinations.

- Stångehuvud – known for its unique granite and nature reserve

- The Sea House – an aquarium focused on the Västerhavet

- Gullmarsfjorden – Sweden’s only fjord with a threshold

A fun fact: Lysekil has been a filming location for several Swedish movies, and its dramatic coastal landscape has inspired artists and writers over the years.

FAQ – Common Questions about Lysekil Municipality

- What is the municipal tax rate in Lysekil?

The municipal tax rate is 22.46%, and combined with the county council tax, it amounts to 33.94% excluding church fee. - How many people live in Lysekil?

Approximately 14,000 residents are registered in the municipality. - Who are the largest employers?

The public sector, tourism, industry, and services are key employers. - What makes Lysekil unique?

Proximity to the sea, granite cliffs, a vibrant community life, and many summer activities.

-

The employer pays

Total cost to the employer

52 305 kr -

Employer fee

This is a fee your employer pays

-12 505 kr -

Your gross salary

This is your salary before deductions, taxes, and fees.

= 39 800 kr -

Basic Allowance

A deduction that lowers taxable income.

-1 442 kr -

Taxable income

This is what taxes and fees are calculated on

=38 358 kr -

Employment tax credit

A tax reduction on earned income, intended to increase work incentives by reducing the tax burden.

+3 020 kr -

Municipal tax

The municipal tax in Lysekil är 22.46%

-8 615 kr -

County tax

The tax in your county is 11.48%

-4 404 kr -

State income tax

An extra 20 percent tax is levied on income above that 540 700 kr per year

-0 kr -

Church fee

If you are a member of the Church of Sweden, you also pay church fees

-0 kr -

Burial fee

A mandatory fee charged by Lysekil stift (i din kommun) 0.29%

-100 kr -

Your net salary

This is what you get to keep after taxes and fees

29 702 kr -

Taxes & Fees

This is what you and the employer paid in total in taxes and fees

22 604 kr

-

The employer pays

Total cost to the employer

52 305 kr -

Employer fee

This is a fee your employer pays

-12 505 kr -

Your gross salary

This is your salary before deductions, taxes, and fees.

= 39 800 kr -

Basic Allowance

A deduction that lowers taxable income.

-1 442 kr -

Taxable income

This is what taxes and fees are calculated on

=38 358 kr -

Employment tax credit

A tax reduction on earned income, intended to increase work incentives by reducing the tax burden.

+3 325 kr -

Municipal tax

The municipal tax in Lysekil är 22.46%

-8 615 kr -

County tax

The tax in your county is 11.48%

-4 404 kr -

State income tax

An extra 20 percent tax is levied on income above that 598 500 kr per year

-0 kr -

Church fee

If you are a member of the Church of Sweden, you also pay church fees

-0 kr -

Burial fee

A mandatory fee charged by Lysekil stift (i din kommun) 0.29%

-100 kr -

Your net salary

This is what you get to keep after taxes and fees

30 007 kr -

Taxes & Fees

This is what you and the employer paid in total in taxes and fees

22 298 kr

-

The employer pays

Total cost to the employer

52 305 kr -

Employer fee

This is a fee your employer pays

-12 505 kr -

Your gross salary

This is your salary before deductions, taxes, and fees.

= 39 800 kr -

Basic Allowance

A deduction that lowers taxable income.

-1 442 kr -

Taxable income

This is what taxes and fees are calculated on

=38 358 kr -

Employment tax credit

A tax reduction on earned income, intended to increase work incentives by reducing the tax burden.

+3 761 kr -

Municipal tax

The municipal tax in Lysekil är 22.46%

-8 615 kr -

County tax

The tax in your county is 11.48%

-4 404 kr -

State income tax

An extra 20 percent tax is levied on income above that 598 500 kr per year

-0 kr -

Church fee

If you are a member of the Church of Sweden, you also pay church fees

-0 kr -

Burial fee

A mandatory fee charged by Lysekil stift (i din kommun) 0.29%

-107 kr -

Your net salary

This is what you get to keep after taxes and fees

30 435 kr -

Taxes & Fees

This is what you and the employer paid in total in taxes and fees

21 870 kr

-

The employer pays

Total cost to the employer

52 305 kr -

Employer fee

This is a fee your employer pays

-12 505 kr -

Your gross salary

This is your salary before deductions, taxes, and fees.

= 39 800 kr -

Basic Allowance

A deduction that lowers taxable income.

-1 442 kr -

Taxable income

This is what taxes and fees are calculated on

=38 358 kr -

Employment tax credit

A tax reduction on earned income, intended to increase work incentives by reducing the tax burden.

+3 761 kr -

Municipal tax

The municipal tax in Lysekil är 22.46%

-8 615 kr -

County tax

The tax in your county is 11.48%

-4 404 kr -

State income tax

An extra 20 percent tax is levied on income above that 625 800 kr per year

-0 kr -

Church fee

If you are a member of the Church of Sweden, you also pay church fees

-0 kr -

Burial fee

A mandatory fee charged by Lysekil stift (i din kommun) 0.29%

-111 kr -

Your net salary

This is what you get to keep after taxes and fees

30 431 kr -

Taxes & Fees

This is what you and the employer paid in total in taxes and fees

21 874 kr

-

The employer pays

Total cost to the employer

52 305 kr -

Employer fee

This is a fee your employer pays

-12 505 kr -

Your gross salary

This is your salary before deductions, taxes, and fees.

= 39 800 kr -

Basic Allowance

A deduction that lowers taxable income.

-1 442 kr -

Taxable income

This is what taxes and fees are calculated on

=38 358 kr -

Employment tax credit

A tax reduction on earned income, intended to increase work incentives by reducing the tax burden.

+3 761 kr -

Municipal tax

The municipal tax in Lysekil är 22.46%

-8 615 kr -

County tax

The tax in your county is 11.48%

-4 404 kr -

State income tax

An extra 20 percent tax is levied on income above that 643 000 kr per year

-0 kr -

Church fee

If you are a member of the Church of Sweden, you also pay church fees

-0 kr -

Burial fee

A mandatory fee charged by Lysekil stift (i din kommun) 0.29%

-111 kr -

Your net salary

This is what you get to keep after taxes and fees

30 431 kr -

Taxes & Fees

This is what you and the employer paid in total in taxes and fees

21 874 kr

| Municipality | Municipal | County council | Total |

|---|---|---|---|

| UPPLANDS VÄSBY | 19.42% | 12.33% | 32.78% |

| VALLENTUNA | 18.9% | 12.33% | 32.26% |

| ÖSTERÅKER | 16.6% | 12.33% | 29.96% |

| VÄRMDÖ | 18.98% | 12.33% | 32.34% |

| JÄRFÄLLA | 19.19% | 12.33% | 32.55% |

| EKERÖ | 19.12% | 12.33% | 32.48% |

| HUDDINGE | 19.38% | 12.33% | 32.74% |

| BOTKYRKA | 19.9% | 12.33% | 33.26% |

| SALEM | 19.67% | 12.33% | 33.03% |

| HANINGE | 18.95% | 12.33% | 32.31% |

| TYRESÖ | 19.5% | 12.33% | 32.86% |

| UPPLANDS-BRO | 19.4% | 12.33% | 32.76% |

| NYKVARN | 19.97% | 12.33% | 33.33% |

| TÄBY | 17.55% | 12.33% | 30.91% |

| DANDERYD | 18.25% | 12.33% | 31.61% |

| SOLLENTUNA | 18.12% | 12.33% | 31.48% |

| STOCKHOLM | 18.22% | 12.33% | 31.58% |

| SÖDERTÄLJE | 20.05% | 12.33% | 33.41% |

| NACKA | 17.78% | 12.33% | 31.14% |

| SUNDBYBERG | 19.25% | 12.33% | 32.61% |

| SOLNA | 17.37% | 12.33% | 30.73% |

| LIDINGÖ | 17.34% | 12.33% | 30.7% |

| VAXHOLM | 19.3% | 12.33% | 32.66% |

| NORRTÄLJE | 19.72% | 12.33% | 33.08% |

| SIGTUNA | 19.5% | 12.33% | 32.86% |

| NYNÄSHAMN | 19.85% | 12.33% | 33.21% |

| HÅBO | 21.59% | 11.71% | 34.69% |

| ÄLVKARLEBY | 22.69% | 11.71% | 35.79% |

| KNIVSTA | 20.91% | 11.71% | 34.01% |

| HEBY | 22.5% | 11.71% | 35.6% |

| TIERP | 21.29% | 11.71% | 34.39% |

| UPPSALA | 21.14% | 11.71% | 34.24% |

| ENKÖPING | 21.34% | 11.71% | 34.44% |

| ÖSTHAMMAR | 21.59% | 11.71% | 34.69% |

| VINGÅKER | 22.67% | 10.83% | 34.91% |

| GNESTA | 22.12% | 10.83% | 34.36% |

| NYKÖPING | 21.42% | 10.83% | 33.66% |

| OXELÖSUND | 22.22% | 10.83% | 34.46% |

| FLEN | 22.27% | 10.83% | 34.51% |

| KATRINEHOLM | 22.12% | 10.83% | 34.36% |

| ESKILSTUNA | 22.02% | 10.83% | 34.26% |

| STRÄNGNÄS | 21.67% | 10.83% | 33.91% |

| TROSA | 21.2% | 10.83% | 33.44% |

| ÖDESHÖG | 22.4% | 11.55% | 35.37% |

| YDRE | 22.55% | 11.55% | 35.52% |

| KINDA | 21.45% | 11.55% | 34.42% |

| BOXHOLM | 21.82% | 11.55% | 34.79% |

| ÅTVIDABERG | 22.39% | 11.55% | 35.36% |

| FINSPÅNG | 22.15% | 11.55% | 35.12% |

| VALDEMARSVIK | 22.48% | 11.55% | 35.45% |

| LINKÖPING | 20.2% | 11.55% | 33.17% |

| NORRKÖPING | 21.75% | 11.55% | 34.72% |

| SÖDERKÖPING | 21.98% | 11.55% | 34.95% |

| MOTALA | 21.7% | 11.55% | 34.67% |

| VADSTENA | 22.8% | 11.55% | 35.77% |

| MJÖLBY | 21.9% | 11.55% | 34.87% |

| ANEBY | 22.09% | 11.76% | 35.32% |

| GNOSJÖ | 22.24% | 11.76% | 35.47% |

| MULLSJÖ | 22.34% | 11.76% | 35.57% |

| HABO | 22.17% | 11.76% | 35.4% |

| GISLAVED | 21.99% | 11.76% | 35.22% |

| VAGGERYD | 21.49% | 11.76% | 34.72% |

| JÖNKÖPING | 21.64% | 11.76% | 34.87% |

| NÄSSJÖ | 22.54% | 11.76% | 35.77% |

| VÄRNAMO | 21.52% | 11.76% | 34.75% |

| SÄVSJÖ | 21.92% | 11.76% | 35.15% |

| VETLANDA | 22.01% | 11.76% | 35.24% |

| EKSJÖ | 22.26% | 11.76% | 35.49% |

| TRANÅS | 22.01% | 11.76% | 35.24% |

| UPPVIDINGE | 21.8% | 12% | 35.26% |

| LESSEBO | 21.81% | 12% | 35.27% |

| TINGSRYD | 22% | 12% | 35.46% |

| ALVESTA | 21.42% | 12% | 34.88% |

| ÄLMHULT | 21.86% | 12% | 35.32% |

| MARKARYD | 21.31% | 12% | 34.77% |

| VÄXJÖ | 20.19% | 12% | 33.65% |

| LJUNGBY | 21.07% | 12% | 34.53% |

| HÖGSBY | 22.21% | 11.86% | 35.62% |

| TORSÅS | 21.93% | 11.86% | 35.34% |

| MÖRBYLÅNGA | 22.21% | 11.86% | 35.62% |

| HULTSFRED | 21.91% | 11.86% | 35.32% |

| MÖNSTERÅS | 22.21% | 11.86% | 35.62% |

| EMMABODA | 21.96% | 11.86% | 35.37% |

| KALMAR | 21.81% | 11.86% | 35.22% |

| NYBRO | 22.33% | 11.86% | 35.74% |

| OSKARSHAMN | 22.35% | 11.86% | 35.76% |

| VÄSTERVIK | 21.16% | 11.86% | 34.57% |

| VIMMERBY | 22.36% | 11.86% | 35.77% |

| BORGHOLM | 21.58% | 11.86% | 34.99% |

| GOTLAND | 33.6% | 0% | 35.5% |

| OLOFSTRÖM | 21.71% | 12.04% | 35.09% |

| KARLSKRONA | 21.65% | 12.04% | 35.03% |

| RONNEBY | 21.64% | 12.04% | 35.02% |

| KARLSHAMN | 21.76% | 12.04% | 35.14% |

| SÖLVESBORG | 21.82% | 12.04% | 35.2% |

| SVALÖV | 20.74% | 11.18% | 33.26% |

| STAFFANSTORP | 18.94% | 11.18% | 31.46% |

| BURLÖV | 20.09% | 11.18% | 32.61% |

| VELLINGE | 18.5% | 11.18% | 31.02% |

| ÖSTRA GÖINGE | 20.99% | 11.18% | 33.51% |

| ÖRKELLJUNGA | 19.06% | 11.18% | 31.58% |

| BJUV | 20.99% | 11.18% | 33.51% |

| KÄVLINGE | 18.41% | 11.18% | 30.93% |

| LOMMA | 19.54% | 11.18% | 32.06% |

| SVEDALA | 20.24% | 11.18% | 32.76% |

| SKURUP | 20.42% | 11.18% | 32.94% |

| SJÖBO | 20.92% | 11.18% | 33.44% |

| HÖRBY | 21.08% | 11.18% | 33.6% |

| HÖÖR | 21.45% | 11.18% | 33.97% |

| TOMELILLA | 20.61% | 11.18% | 33.13% |

| BROMÖLLA | 22.56% | 11.18% | 35.08% |

| OSBY | 22.81% | 11.18% | 35.33% |

| PERSTORP | 20.81% | 11.18% | 33.33% |

| KLIPPAN | 20.75% | 11.18% | 33.27% |

| ÅSTORP | 20.29% | 11.18% | 32.81% |

| BÅSTAD | 20.23% | 11.18% | 32.75% |

| MALMÖ | 21.24% | 11.18% | 33.76% |

| LUND | 21.24% | 11.18% | 33.76% |

| LANDSKRONA | 20.24% | 11.18% | 32.76% |

| HELSINGBORG | 20.21% | 11.18% | 32.73% |

| HÖGANÄS | 19.73% | 11.18% | 32.25% |

| ESLÖV | 20.54% | 11.18% | 33.06% |

| YSTAD | 20.11% | 11.18% | 32.63% |

| TRELLEBORG | 20.4% | 11.18% | 32.92% |

| KRISTIANSTAD | 21.46% | 11.18% | 33.98% |

| SIMRISHAMN | 20.51% | 11.18% | 33.03% |

| ÄNGELHOLM | 20.17% | 11.18% | 32.69% |

| HÄSSLEHOLM | 21.2% | 11.18% | 33.72% |

| HYLTE | 22.45% | 11.4% | 35.32% |

| HALMSTAD | 20.98% | 11.4% | 33.85% |

| LAHOLM | 21.4% | 11.4% | 34.27% |

| FALKENBERG | 21.1% | 11.4% | 33.97% |

| VARBERG | 20.33% | 11.4% | 33.2% |

| KUNGSBACKA | 21.18% | 11.4% | 34.05% |

| HÄRRYDA | 20.5% | 11.48% | 33.35% |

| PARTILLE | 19.88% | 11.48% | 32.73% |

| ÖCKERÖ | 21.56% | 11.48% | 34.41% |

| STENUNGSUND | 21.64% | 11.48% | 34.49% |

| TJÖRN | 21.71% | 11.48% | 34.56% |

| ORUST | 22.21% | 11.48% | 35.06% |

| SOTENÄS | 21.99% | 11.48% | 34.84% |

| MUNKEDAL | 23.38% | 11.48% | 36.23% |

| TANUM | 21.56% | 11.48% | 34.41% |

| DALS-ED | 23.21% | 11.48% | 36.06% |

| FÄRGELANDA | 22.91% | 11.48% | 35.76% |

| ALE | 21.32% | 11.48% | 34.17% |

| LERUM | 20.55% | 11.48% | 33.4% |

| VÅRGÅRDA | 21.61% | 11.48% | 34.46% |

| BOLLEBYGD | 21.59% | 11.48% | 34.44% |

| GRÄSTORP | 21.99% | 11.48% | 34.84% |

| ESSUNGA | 21.57% | 11.48% | 34.42% |

| KARLSBORG | 21.32% | 11.48% | 34.17% |

| GULLSPÅNG | 22.49% | 11.48% | 35.34% |

| TRANEMO | 21.5% | 11.48% | 34.35% |

| BENGTSFORS | 22.92% | 11.48% | 35.77% |

| MELLERUD | 22.6% | 11.48% | 35.45% |

| LILLA EDET | 22.37% | 11.48% | 35.22% |

| MARK | 21.51% | 11.48% | 34.36% |

| SVENLJUNGA | 22.05% | 11.48% | 34.9% |

| HERRLJUNGA | 22.14% | 11.48% | 34.99% |

| VARA | 21.77% | 11.48% | 34.62% |

| GÖTENE | 22.12% | 11.48% | 34.97% |

| TIBRO | 21.71% | 11.48% | 34.56% |

| TÖREBODA | 21.72% | 11.48% | 34.57% |

| GÖTEBORG | 21.12% | 11.48% | 33.97% |

| MÖLNDAL | 20.51% | 11.48% | 33.36% |

| KUNGÄLV | 21.44% | 11.48% | 34.29% |

| LYSEKIL | 22.46% | 11.48% | 35.31% |

| UDDEVALLA | 22.16% | 11.48% | 35.01% |

| STRÖMSTAD | 21.91% | 11.48% | 34.76% |

| VÄNERSBORG | 22.21% | 11.48% | 35.06% |

| TROLLHÄTTAN | 22.36% | 11.48% | 35.21% |

| ALINGSÅS | 21.36% | 11.48% | 34.21% |

| BORÅS | 21.31% | 11.48% | 34.16% |

| ULRICEHAMN | 21.05% | 11.48% | 33.9% |

| ÅMÅL | 22.46% | 11.48% | 35.31% |

| MARIESTAD | 21.26% | 11.48% | 34.11% |

| LIDKÖPING | 21.26% | 11.48% | 34.11% |

| SKARA | 21.9% | 11.48% | 34.75% |

| SKÖVDE | 21.61% | 11.48% | 34.46% |

| HJO | 22% | 11.48% | 34.85% |

| TIDAHOLM | 22.07% | 11.48% | 34.92% |

| FALKÖPING | 21.95% | 11.48% | 34.8% |

| KIL | 22.35% | 12.28% | 36.06% |

| EDA | 22.27% | 12.28% | 35.98% |

| TORSBY | 22.02% | 12.28% | 35.73% |

| STORFORS | 22.7% | 12.28% | 36.41% |

| HAMMARÖ | 22.77% | 12.28% | 36.48% |

| MUNKFORS | 22.02% | 12.28% | 35.73% |

| FORSHAGA | 22.35% | 12.28% | 36.06% |

| GRUMS | 22.5% | 12.28% | 36.21% |

| ÅRJÄNG | 21.97% | 12.28% | 35.68% |

| SUNNE | 21.47% | 12.28% | 35.18% |

| KARLSTAD | 21.27% | 12.28% | 34.98% |

| KRISTINEHAMN | 21.97% | 12.28% | 35.68% |

| FILIPSTAD | 22.27% | 12.28% | 35.98% |

| HAGFORS | 22.02% | 12.28% | 35.73% |

| ARVIKA | 21.75% | 12.28% | 35.46% |

| SÄFFLE | 21.52% | 12.28% | 35.23% |

| LEKEBERG | 21.43% | 12.3% | 35.08% |

| LAXÅ | 22.7% | 12.3% | 36.35% |

| HALLSBERG | 21.55% | 12.3% | 35.2% |

| DEGERFORS | 23% | 12.3% | 36.65% |

| HÄLLEFORS | 22.05% | 12.3% | 35.7% |

| LJUSNARSBERG | 21.5% | 12.3% | 35.15% |

| ÖREBRO | 21.35% | 12.3% | 35% |

| KUMLA | 21.54% | 12.3% | 35.19% |

| ASKERSUND | 21.85% | 12.3% | 35.5% |

| KARLSKOGA | 22% | 12.3% | 35.65% |

| NORA | 22.25% | 12.3% | 35.9% |

| LINDESBERG | 22.3% | 12.3% | 35.95% |

| SKINNSKATTEBERG | 22.46% | 10.88% | 34.69% |

| SURAHAMMAR | 22.31% | 10.88% | 34.54% |

| KUNGSÖR | 22.03% | 10.88% | 34.26% |

| HALLSTAHAMMAR | 21.81% | 10.88% | 34.04% |

| NORBERG | 22.66% | 10.88% | 34.89% |

| VÄSTERÅS | 20.36% | 10.88% | 32.59% |

| SALA | 22.31% | 10.88% | 34.54% |

| FAGERSTA | 22.11% | 10.88% | 34.34% |

| KÖPING | 22.16% | 10.88% | 34.39% |

| ARBOGA | 22.41% | 10.88% | 34.64% |

| VANSBRO | 22.29% | 11.99% | 35.72% |

| MALUNG-SÄLEN | 22.46% | 11.99% | 35.89% |

| GAGNEF | 22.28% | 11.99% | 35.71% |

| LEKSAND | 21.81% | 11.99% | 35.24% |

| RÄTTVIK | 21.81% | 11.99% | 35.24% |

| ORSA | 22.31% | 11.99% | 35.74% |

| ÄLVDALEN | 22.78% | 11.99% | 36.21% |

| SMEDJEBACKEN | 22.45% | 11.99% | 35.88% |

| MORA | 22.33% | 11.99% | 35.76% |

| FALUN | 22.06% | 11.99% | 35.49% |

| BORLÄNGE | 22.41% | 11.99% | 35.84% |

| SÄTER | 22.31% | 11.99% | 35.74% |

| HEDEMORA | 22.16% | 11.99% | 35.59% |

| AVESTA | 21.96% | 11.99% | 35.39% |

| LUDVIKA | 22.06% | 11.99% | 35.49% |

| OCKELBO | 22.76% | 11.51% | 35.63% |

| HOFORS | 22.86% | 11.51% | 35.73% |

| OVANÅKER | 21.86% | 11.51% | 34.73% |

| NORDANSTIG | 22.51% | 11.51% | 35.38% |

| LJUSDAL | 22.36% | 11.51% | 35.23% |

| GÄVLE | 22.26% | 11.51% | 35.13% |

| SANDVIKEN | 21.61% | 11.51% | 34.48% |

| SÖDERHAMN | 21.66% | 11.51% | 34.53% |

| BOLLNÄS | 21.86% | 11.51% | 34.73% |

| HUDIKSVALL | 21.61% | 11.51% | 34.48% |

| ÅNGE | 23.33% | 11.29% | 36.33% |

| TIMRÅ | 23.09% | 11.29% | 36.09% |

| HÄRNÖSAND | 23.34% | 11.29% | 36.34% |

| SUNDSVALL | 22.59% | 11.29% | 35.59% |

| KRAMFORS | 23.14% | 11.29% | 36.14% |

| SOLLEFTEÅ | 23.39% | 11.29% | 36.39% |

| ÖRNSKÖLDSVIK | 22.56% | 11.29% | 35.56% |

| RAGUNDA | 23.22% | 11.7% | 36.61% |

| BRÄCKE | 23.39% | 11.7% | 36.78% |

| KROKOM | 22.17% | 11.7% | 35.56% |

| STRÖMSUND | 23.22% | 11.7% | 36.61% |

| ÅRE | 22.22% | 11.7% | 35.61% |

| BERG | 22.52% | 11.7% | 35.91% |

| HÄRJEDALEN | 22.47% | 11.7% | 35.86% |

| ÖSTERSUND | 22.02% | 11.7% | 35.41% |

| NORDMALING | 23.25% | 11.85% | 36.49% |

| BJURHOLM | 23.15% | 11.85% | 36.39% |

| VINDELN | 23.35% | 11.85% | 36.59% |

| ROBERTSFORS | 23.15% | 11.85% | 36.39% |

| NORSJÖ | 23.35% | 11.85% | 36.59% |

| MALÅ | 23.35% | 11.85% | 36.59% |

| STORUMAN | 23.1% | 11.85% | 36.34% |

| SORSELE | 23.6% | 11.85% | 36.84% |

| DOROTEA | 23.8% | 11.85% | 37.04% |

| VÄNNÄS | 23.35% | 11.85% | 36.59% |

| VILHELMINA | 23.65% | 11.85% | 36.89% |

| ÅSELE | 23.6% | 11.85% | 36.84% |

| UMEÅ | 22.8% | 11.85% | 36.04% |

| LYCKSELE | 23.05% | 11.85% | 36.29% |

| SKELLEFTEÅ | 22.6% | 11.85% | 35.84% |

| ARVIDSJAUR | 22.8% | 11.34% | 35.43% |

| ARJEPLOG | 23.5% | 11.34% | 36.13% |

| JOKKMOKK | 22.95% | 11.34% | 35.58% |

| ÖVERKALIX | 22.8% | 11.34% | 35.43% |

| KALIX | 22.55% | 11.34% | 35.18% |

| ÖVERTORNEÅ | 22.5% | 11.34% | 35.13% |

| PAJALA | 23.4% | 11.34% | 36.03% |

| GÄLLIVARE | 22.55% | 11.34% | 35.18% |

| ÄLVSBYN | 22.45% | 11.34% | 35.08% |

| LULEÅ | 22.5% | 11.34% | 35.13% |

| PITEÅ | 22.25% | 11.34% | 34.88% |

| BODEN | 22.6% | 11.34% | 35.23% |

| HAPARANDA | 22.5% | 11.34% | 35.13% |

| KIRUNA | 23.05% | 11.34% | 35.68% |