Calculate Swedish Tax / Net Salary in Amal municipality

- Home

- Calculate Take-Home Pay, Net Salary

Åmål Municipality – Facts, Statistics, and Insights

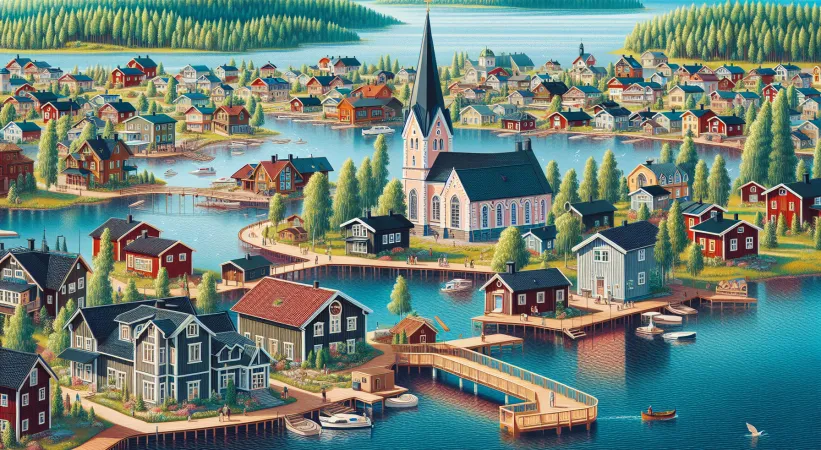

Åmål Municipality, beautifully situated on the northern shore of Vänern in Dalsland, is a place where small-town charm meets proximity to water and forest. Here, historic environments, a vibrant cultural life, and good opportunities for both entrepreneurs and nature enthusiasts coexist. Despite its relatively small size, Åmål has a clear identity and attracts residents and visitors with its location and quality of life.

Population and Demographics

Åmål is one of Västra Götaland’s smaller municipalities, with approximately 12,000 residents. The population has remained relatively stable in recent years, but like many rural municipalities, it has a higher proportion of elderly compared to the national average. At the same time, interest in moving in is growing, especially among families with children seeking proximity to nature, safety, and good municipal services.

- Approximately 80% of the population lives in the town of Åmål

- The age distribution shows a strong share of 65+ but also a balanced proportion of younger children

- Immigration has contributed to population development in recent years

It is striking how Åmål manages to combine small-town life with proximity to Vänern’s waters – something that is evident both in the cultural scene and residents’ leisure activities.

Tax, Welfare, and Municipal Services

Åmål Municipality has a municipal tax rate of 22.46%, which together with the county council tax (11.48%) results in a total tax burden of 33.94% (excluding church fee). The burial fee is 0.29%, and for members of the Church of Sweden, an additional church fee of 1.37% applies.

- Tax revenues are primarily used for schools, healthcare, and social services

- The municipality invests in elderly care and senior housing

- The primary schools are spread across both town and countryside areas

Despite challenges related to an aging population and strained welfare finances, Åmål has a tradition of prioritizing proximity to services and high accessibility – for example, in childcare and leisure activities.

Economy and Labor Market

The business sector in Åmål is characterized by small and medium-sized enterprises, with manufacturing, service, and retail dominating. The municipality collaborates closely with businesses to create more jobs and attract investments.

- The largest employers are the municipality itself, followed by companies in industry and healthcare

- Unemployment is slightly above the national average, but the municipality has several initiatives to strengthen the labor market

- Significant efforts are made to attract entrepreneurs and develop tourism around Vänern

Åmål also has a tradition of supporting young people and newcomers into the labor market, including through collaborations with educational providers and internships in local businesses.

Geography and Attractions

Åmål is known for its location by Vänern, Sweden’s largest lake, and for its lively small-town atmosphere. The city has a well-preserved city center with wooden houses and cobblestone streets, attracting visitors with events such as Bluesfesten and Art in Åmål.

- The Vänern archipelago offers swimming, fishing, and boating opportunities

- Åmålån river runs through the city, contributing to the natural feel

- Nature reserves and hiking trails are within close reach

Among the municipality’s unique features are the many cultural associations and a strong tradition of music and art – something that has become a hallmark of Åmål nationwide.

FAQ – Common Questions about Åmål Municipality

- What is the municipal tax rate in Åmål?

The municipal tax rate is 22.46%. Including the county council tax, it totals 33.94% (excluding church fee). - What are tax revenues used for?

The largest portions go to schools, healthcare, and social services, but infrastructure and culture also receive a share. - How is the labor market in Åmål?

The labor market is dominated by the public sector, industry, and retail. The municipality actively works to create more jobs and promote new businesses. - What makes Åmål an attractive place to live?

Proximity to Vänern, small-town feel, and a rich cultural and community life make Åmål appealing to many.

-

The employer pays

Total cost to the employer

52 305 kr -

Employer fee

This is a fee your employer pays

-12 505 kr -

Your gross salary

This is your salary before deductions, taxes, and fees.

= 39 800 kr -

Basic Allowance

A deduction that lowers taxable income.

-1 442 kr -

Taxable income

This is what taxes and fees are calculated on

=38 358 kr -

Employment tax credit

A tax reduction on earned income, intended to increase work incentives by reducing the tax burden.

+3 020 kr -

Municipal tax

The municipal tax in åmål är 22.46%

-8 615 kr -

County tax

The tax in your county is 11.48%

-4 404 kr -

State income tax

An extra 20 percent tax is levied on income above that 540 700 kr per year

-0 kr -

Church fee

If you are a member of the Church of Sweden, you also pay church fees

-0 kr -

Burial fee

A mandatory fee charged by åmål stift (i din kommun) 0.29%

-100 kr -

Your net salary

This is what you get to keep after taxes and fees

29 702 kr -

Taxes & Fees

This is what you and the employer paid in total in taxes and fees

22 604 kr

-

The employer pays

Total cost to the employer

52 305 kr -

Employer fee

This is a fee your employer pays

-12 505 kr -

Your gross salary

This is your salary before deductions, taxes, and fees.

= 39 800 kr -

Basic Allowance

A deduction that lowers taxable income.

-1 442 kr -

Taxable income

This is what taxes and fees are calculated on

=38 358 kr -

Employment tax credit

A tax reduction on earned income, intended to increase work incentives by reducing the tax burden.

+3 325 kr -

Municipal tax

The municipal tax in åmål är 22.46%

-8 615 kr -

County tax

The tax in your county is 11.48%

-4 404 kr -

State income tax

An extra 20 percent tax is levied on income above that 598 500 kr per year

-0 kr -

Church fee

If you are a member of the Church of Sweden, you also pay church fees

-0 kr -

Burial fee

A mandatory fee charged by åmål stift (i din kommun) 0.29%

-100 kr -

Your net salary

This is what you get to keep after taxes and fees

30 007 kr -

Taxes & Fees

This is what you and the employer paid in total in taxes and fees

22 298 kr

-

The employer pays

Total cost to the employer

52 305 kr -

Employer fee

This is a fee your employer pays

-12 505 kr -

Your gross salary

This is your salary before deductions, taxes, and fees.

= 39 800 kr -

Basic Allowance

A deduction that lowers taxable income.

-1 442 kr -

Taxable income

This is what taxes and fees are calculated on

=38 358 kr -

Employment tax credit

A tax reduction on earned income, intended to increase work incentives by reducing the tax burden.

+3 761 kr -

Municipal tax

The municipal tax in åmål är 22.46%

-8 615 kr -

County tax

The tax in your county is 11.48%

-4 404 kr -

State income tax

An extra 20 percent tax is levied on income above that 598 500 kr per year

-0 kr -

Church fee

If you are a member of the Church of Sweden, you also pay church fees

-0 kr -

Burial fee

A mandatory fee charged by åmål stift (i din kommun) 0.29%

-107 kr -

Your net salary

This is what you get to keep after taxes and fees

30 435 kr -

Taxes & Fees

This is what you and the employer paid in total in taxes and fees

21 870 kr

-

The employer pays

Total cost to the employer

52 305 kr -

Employer fee

This is a fee your employer pays

-12 505 kr -

Your gross salary

This is your salary before deductions, taxes, and fees.

= 39 800 kr -

Basic Allowance

A deduction that lowers taxable income.

-1 442 kr -

Taxable income

This is what taxes and fees are calculated on

=38 358 kr -

Employment tax credit

A tax reduction on earned income, intended to increase work incentives by reducing the tax burden.

+3 761 kr -

Municipal tax

The municipal tax in åmål är 22.46%

-8 615 kr -

County tax

The tax in your county is 11.48%

-4 404 kr -

State income tax

An extra 20 percent tax is levied on income above that 625 800 kr per year

-0 kr -

Church fee

If you are a member of the Church of Sweden, you also pay church fees

-0 kr -

Burial fee

A mandatory fee charged by åmål stift (i din kommun) 0.29%

-111 kr -

Your net salary

This is what you get to keep after taxes and fees

30 431 kr -

Taxes & Fees

This is what you and the employer paid in total in taxes and fees

21 874 kr

-

The employer pays

Total cost to the employer

52 305 kr -

Employer fee

This is a fee your employer pays

-12 505 kr -

Your gross salary

This is your salary before deductions, taxes, and fees.

= 39 800 kr -

Basic Allowance

A deduction that lowers taxable income.

-1 442 kr -

Taxable income

This is what taxes and fees are calculated on

=38 358 kr -

Employment tax credit

A tax reduction on earned income, intended to increase work incentives by reducing the tax burden.

+3 761 kr -

Municipal tax

The municipal tax in åmål är 22.46%

-8 615 kr -

County tax

The tax in your county is 11.48%

-4 404 kr -

State income tax

An extra 20 percent tax is levied on income above that 643 000 kr per year

-0 kr -

Church fee

If you are a member of the Church of Sweden, you also pay church fees

-0 kr -

Burial fee

A mandatory fee charged by åmål stift (i din kommun) 0.29%

-111 kr -

Your net salary

This is what you get to keep after taxes and fees

30 431 kr -

Taxes & Fees

This is what you and the employer paid in total in taxes and fees

21 874 kr

| Municipality | Municipal | County council | Total |

|---|---|---|---|

| UPPLANDS VÄSBY | 19.42% | 12.33% | 32.78% |

| VALLENTUNA | 18.9% | 12.33% | 32.26% |

| ÖSTERÅKER | 16.6% | 12.33% | 29.96% |

| VÄRMDÖ | 18.98% | 12.33% | 32.34% |

| JÄRFÄLLA | 19.19% | 12.33% | 32.55% |

| EKERÖ | 19.12% | 12.33% | 32.48% |

| HUDDINGE | 19.38% | 12.33% | 32.74% |

| BOTKYRKA | 19.9% | 12.33% | 33.26% |

| SALEM | 19.67% | 12.33% | 33.03% |

| HANINGE | 18.95% | 12.33% | 32.31% |

| TYRESÖ | 19.5% | 12.33% | 32.86% |

| UPPLANDS-BRO | 19.4% | 12.33% | 32.76% |

| NYKVARN | 19.97% | 12.33% | 33.33% |

| TÄBY | 17.55% | 12.33% | 30.91% |

| DANDERYD | 18.25% | 12.33% | 31.61% |

| SOLLENTUNA | 18.12% | 12.33% | 31.48% |

| STOCKHOLM | 18.22% | 12.33% | 31.58% |

| SÖDERTÄLJE | 20.05% | 12.33% | 33.41% |

| NACKA | 17.78% | 12.33% | 31.14% |

| SUNDBYBERG | 19.25% | 12.33% | 32.61% |

| SOLNA | 17.37% | 12.33% | 30.73% |

| LIDINGÖ | 17.34% | 12.33% | 30.7% |

| VAXHOLM | 19.3% | 12.33% | 32.66% |

| NORRTÄLJE | 19.72% | 12.33% | 33.08% |

| SIGTUNA | 19.5% | 12.33% | 32.86% |

| NYNÄSHAMN | 19.85% | 12.33% | 33.21% |

| HÅBO | 21.59% | 11.71% | 34.69% |

| ÄLVKARLEBY | 22.69% | 11.71% | 35.79% |

| KNIVSTA | 20.91% | 11.71% | 34.01% |

| HEBY | 22.5% | 11.71% | 35.6% |

| TIERP | 21.29% | 11.71% | 34.39% |

| UPPSALA | 21.14% | 11.71% | 34.24% |

| ENKÖPING | 21.34% | 11.71% | 34.44% |

| ÖSTHAMMAR | 21.59% | 11.71% | 34.69% |

| VINGÅKER | 22.67% | 10.83% | 34.91% |

| GNESTA | 22.12% | 10.83% | 34.36% |

| NYKÖPING | 21.42% | 10.83% | 33.66% |

| OXELÖSUND | 22.22% | 10.83% | 34.46% |

| FLEN | 22.27% | 10.83% | 34.51% |

| KATRINEHOLM | 22.12% | 10.83% | 34.36% |

| ESKILSTUNA | 22.02% | 10.83% | 34.26% |

| STRÄNGNÄS | 21.67% | 10.83% | 33.91% |

| TROSA | 21.2% | 10.83% | 33.44% |

| ÖDESHÖG | 22.4% | 11.55% | 35.37% |

| YDRE | 22.55% | 11.55% | 35.52% |

| KINDA | 21.45% | 11.55% | 34.42% |

| BOXHOLM | 21.82% | 11.55% | 34.79% |

| ÅTVIDABERG | 22.39% | 11.55% | 35.36% |

| FINSPÅNG | 22.15% | 11.55% | 35.12% |

| VALDEMARSVIK | 22.48% | 11.55% | 35.45% |

| LINKÖPING | 20.2% | 11.55% | 33.17% |

| NORRKÖPING | 21.75% | 11.55% | 34.72% |

| SÖDERKÖPING | 21.98% | 11.55% | 34.95% |

| MOTALA | 21.7% | 11.55% | 34.67% |

| VADSTENA | 22.8% | 11.55% | 35.77% |

| MJÖLBY | 21.9% | 11.55% | 34.87% |

| ANEBY | 22.09% | 11.76% | 35.32% |

| GNOSJÖ | 22.24% | 11.76% | 35.47% |

| MULLSJÖ | 22.34% | 11.76% | 35.57% |

| HABO | 22.17% | 11.76% | 35.4% |

| GISLAVED | 21.99% | 11.76% | 35.22% |

| VAGGERYD | 21.49% | 11.76% | 34.72% |

| JÖNKÖPING | 21.64% | 11.76% | 34.87% |

| NÄSSJÖ | 22.54% | 11.76% | 35.77% |

| VÄRNAMO | 21.52% | 11.76% | 34.75% |

| SÄVSJÖ | 21.92% | 11.76% | 35.15% |

| VETLANDA | 22.01% | 11.76% | 35.24% |

| EKSJÖ | 22.26% | 11.76% | 35.49% |

| TRANÅS | 22.01% | 11.76% | 35.24% |

| UPPVIDINGE | 21.8% | 12% | 35.26% |

| LESSEBO | 21.81% | 12% | 35.27% |

| TINGSRYD | 22% | 12% | 35.46% |

| ALVESTA | 21.42% | 12% | 34.88% |

| ÄLMHULT | 21.86% | 12% | 35.32% |

| MARKARYD | 21.31% | 12% | 34.77% |

| VÄXJÖ | 20.19% | 12% | 33.65% |

| LJUNGBY | 21.07% | 12% | 34.53% |

| HÖGSBY | 22.21% | 11.86% | 35.62% |

| TORSÅS | 21.93% | 11.86% | 35.34% |

| MÖRBYLÅNGA | 22.21% | 11.86% | 35.62% |

| HULTSFRED | 21.91% | 11.86% | 35.32% |

| MÖNSTERÅS | 22.21% | 11.86% | 35.62% |

| EMMABODA | 21.96% | 11.86% | 35.37% |

| KALMAR | 21.81% | 11.86% | 35.22% |

| NYBRO | 22.33% | 11.86% | 35.74% |

| OSKARSHAMN | 22.35% | 11.86% | 35.76% |

| VÄSTERVIK | 21.16% | 11.86% | 34.57% |

| VIMMERBY | 22.36% | 11.86% | 35.77% |

| BORGHOLM | 21.58% | 11.86% | 34.99% |

| GOTLAND | 33.6% | 0% | 35.5% |

| OLOFSTRÖM | 21.71% | 12.04% | 35.09% |

| KARLSKRONA | 21.65% | 12.04% | 35.03% |

| RONNEBY | 21.64% | 12.04% | 35.02% |

| KARLSHAMN | 21.76% | 12.04% | 35.14% |

| SÖLVESBORG | 21.82% | 12.04% | 35.2% |

| SVALÖV | 20.74% | 11.18% | 33.26% |

| STAFFANSTORP | 18.94% | 11.18% | 31.46% |

| BURLÖV | 20.09% | 11.18% | 32.61% |

| VELLINGE | 18.5% | 11.18% | 31.02% |

| ÖSTRA GÖINGE | 20.99% | 11.18% | 33.51% |

| ÖRKELLJUNGA | 19.06% | 11.18% | 31.58% |

| BJUV | 20.99% | 11.18% | 33.51% |

| KÄVLINGE | 18.41% | 11.18% | 30.93% |

| LOMMA | 19.54% | 11.18% | 32.06% |

| SVEDALA | 20.24% | 11.18% | 32.76% |

| SKURUP | 20.42% | 11.18% | 32.94% |

| SJÖBO | 20.92% | 11.18% | 33.44% |

| HÖRBY | 21.08% | 11.18% | 33.6% |

| HÖÖR | 21.45% | 11.18% | 33.97% |

| TOMELILLA | 20.61% | 11.18% | 33.13% |

| BROMÖLLA | 22.56% | 11.18% | 35.08% |

| OSBY | 22.81% | 11.18% | 35.33% |

| PERSTORP | 20.81% | 11.18% | 33.33% |

| KLIPPAN | 20.75% | 11.18% | 33.27% |

| ÅSTORP | 20.29% | 11.18% | 32.81% |

| BÅSTAD | 20.23% | 11.18% | 32.75% |

| MALMÖ | 21.24% | 11.18% | 33.76% |

| LUND | 21.24% | 11.18% | 33.76% |

| LANDSKRONA | 20.24% | 11.18% | 32.76% |

| HELSINGBORG | 20.21% | 11.18% | 32.73% |

| HÖGANÄS | 19.73% | 11.18% | 32.25% |

| ESLÖV | 20.54% | 11.18% | 33.06% |

| YSTAD | 20.11% | 11.18% | 32.63% |

| TRELLEBORG | 20.4% | 11.18% | 32.92% |

| KRISTIANSTAD | 21.46% | 11.18% | 33.98% |

| SIMRISHAMN | 20.51% | 11.18% | 33.03% |

| ÄNGELHOLM | 20.17% | 11.18% | 32.69% |

| HÄSSLEHOLM | 21.2% | 11.18% | 33.72% |

| HYLTE | 22.45% | 11.4% | 35.32% |

| HALMSTAD | 20.98% | 11.4% | 33.85% |

| LAHOLM | 21.4% | 11.4% | 34.27% |

| FALKENBERG | 21.1% | 11.4% | 33.97% |

| VARBERG | 20.33% | 11.4% | 33.2% |

| KUNGSBACKA | 21.18% | 11.4% | 34.05% |

| HÄRRYDA | 20.5% | 11.48% | 33.35% |

| PARTILLE | 19.88% | 11.48% | 32.73% |

| ÖCKERÖ | 21.56% | 11.48% | 34.41% |

| STENUNGSUND | 21.64% | 11.48% | 34.49% |

| TJÖRN | 21.71% | 11.48% | 34.56% |

| ORUST | 22.21% | 11.48% | 35.06% |

| SOTENÄS | 21.99% | 11.48% | 34.84% |

| MUNKEDAL | 23.38% | 11.48% | 36.23% |

| TANUM | 21.56% | 11.48% | 34.41% |

| DALS-ED | 23.21% | 11.48% | 36.06% |

| FÄRGELANDA | 22.91% | 11.48% | 35.76% |

| ALE | 21.32% | 11.48% | 34.17% |

| LERUM | 20.55% | 11.48% | 33.4% |

| VÅRGÅRDA | 21.61% | 11.48% | 34.46% |

| BOLLEBYGD | 21.59% | 11.48% | 34.44% |

| GRÄSTORP | 21.99% | 11.48% | 34.84% |

| ESSUNGA | 21.57% | 11.48% | 34.42% |

| KARLSBORG | 21.32% | 11.48% | 34.17% |

| GULLSPÅNG | 22.49% | 11.48% | 35.34% |

| TRANEMO | 21.5% | 11.48% | 34.35% |

| BENGTSFORS | 22.92% | 11.48% | 35.77% |

| MELLERUD | 22.6% | 11.48% | 35.45% |

| LILLA EDET | 22.37% | 11.48% | 35.22% |

| MARK | 21.51% | 11.48% | 34.36% |

| SVENLJUNGA | 22.05% | 11.48% | 34.9% |

| HERRLJUNGA | 22.14% | 11.48% | 34.99% |

| VARA | 21.77% | 11.48% | 34.62% |

| GÖTENE | 22.12% | 11.48% | 34.97% |

| TIBRO | 21.71% | 11.48% | 34.56% |

| TÖREBODA | 21.72% | 11.48% | 34.57% |

| GÖTEBORG | 21.12% | 11.48% | 33.97% |

| MÖLNDAL | 20.51% | 11.48% | 33.36% |

| KUNGÄLV | 21.44% | 11.48% | 34.29% |

| LYSEKIL | 22.46% | 11.48% | 35.31% |

| UDDEVALLA | 22.16% | 11.48% | 35.01% |

| STRÖMSTAD | 21.91% | 11.48% | 34.76% |

| VÄNERSBORG | 22.21% | 11.48% | 35.06% |

| TROLLHÄTTAN | 22.36% | 11.48% | 35.21% |

| ALINGSÅS | 21.36% | 11.48% | 34.21% |

| BORÅS | 21.31% | 11.48% | 34.16% |

| ULRICEHAMN | 21.05% | 11.48% | 33.9% |

| ÅMÅL | 22.46% | 11.48% | 35.31% |

| MARIESTAD | 21.26% | 11.48% | 34.11% |

| LIDKÖPING | 21.26% | 11.48% | 34.11% |

| SKARA | 21.9% | 11.48% | 34.75% |

| SKÖVDE | 21.61% | 11.48% | 34.46% |

| HJO | 22% | 11.48% | 34.85% |

| TIDAHOLM | 22.07% | 11.48% | 34.92% |

| FALKÖPING | 21.95% | 11.48% | 34.8% |

| KIL | 22.35% | 12.28% | 36.06% |

| EDA | 22.27% | 12.28% | 35.98% |

| TORSBY | 22.02% | 12.28% | 35.73% |

| STORFORS | 22.7% | 12.28% | 36.41% |

| HAMMARÖ | 22.77% | 12.28% | 36.48% |

| MUNKFORS | 22.02% | 12.28% | 35.73% |

| FORSHAGA | 22.35% | 12.28% | 36.06% |

| GRUMS | 22.5% | 12.28% | 36.21% |

| ÅRJÄNG | 21.97% | 12.28% | 35.68% |

| SUNNE | 21.47% | 12.28% | 35.18% |

| KARLSTAD | 21.27% | 12.28% | 34.98% |

| KRISTINEHAMN | 21.97% | 12.28% | 35.68% |

| FILIPSTAD | 22.27% | 12.28% | 35.98% |

| HAGFORS | 22.02% | 12.28% | 35.73% |

| ARVIKA | 21.75% | 12.28% | 35.46% |

| SÄFFLE | 21.52% | 12.28% | 35.23% |

| LEKEBERG | 21.43% | 12.3% | 35.08% |

| LAXÅ | 22.7% | 12.3% | 36.35% |

| HALLSBERG | 21.55% | 12.3% | 35.2% |

| DEGERFORS | 23% | 12.3% | 36.65% |

| HÄLLEFORS | 22.05% | 12.3% | 35.7% |

| LJUSNARSBERG | 21.5% | 12.3% | 35.15% |

| ÖREBRO | 21.35% | 12.3% | 35% |

| KUMLA | 21.54% | 12.3% | 35.19% |

| ASKERSUND | 21.85% | 12.3% | 35.5% |

| KARLSKOGA | 22% | 12.3% | 35.65% |

| NORA | 22.25% | 12.3% | 35.9% |

| LINDESBERG | 22.3% | 12.3% | 35.95% |

| SKINNSKATTEBERG | 22.46% | 10.88% | 34.69% |

| SURAHAMMAR | 22.31% | 10.88% | 34.54% |

| KUNGSÖR | 22.03% | 10.88% | 34.26% |

| HALLSTAHAMMAR | 21.81% | 10.88% | 34.04% |

| NORBERG | 22.66% | 10.88% | 34.89% |

| VÄSTERÅS | 20.36% | 10.88% | 32.59% |

| SALA | 22.31% | 10.88% | 34.54% |

| FAGERSTA | 22.11% | 10.88% | 34.34% |

| KÖPING | 22.16% | 10.88% | 34.39% |

| ARBOGA | 22.41% | 10.88% | 34.64% |

| VANSBRO | 22.29% | 11.99% | 35.72% |

| MALUNG-SÄLEN | 22.46% | 11.99% | 35.89% |

| GAGNEF | 22.28% | 11.99% | 35.71% |

| LEKSAND | 21.81% | 11.99% | 35.24% |

| RÄTTVIK | 21.81% | 11.99% | 35.24% |

| ORSA | 22.31% | 11.99% | 35.74% |

| ÄLVDALEN | 22.78% | 11.99% | 36.21% |

| SMEDJEBACKEN | 22.45% | 11.99% | 35.88% |

| MORA | 22.33% | 11.99% | 35.76% |

| FALUN | 22.06% | 11.99% | 35.49% |

| BORLÄNGE | 22.41% | 11.99% | 35.84% |

| SÄTER | 22.31% | 11.99% | 35.74% |

| HEDEMORA | 22.16% | 11.99% | 35.59% |

| AVESTA | 21.96% | 11.99% | 35.39% |

| LUDVIKA | 22.06% | 11.99% | 35.49% |

| OCKELBO | 22.76% | 11.51% | 35.63% |

| HOFORS | 22.86% | 11.51% | 35.73% |

| OVANÅKER | 21.86% | 11.51% | 34.73% |

| NORDANSTIG | 22.51% | 11.51% | 35.38% |

| LJUSDAL | 22.36% | 11.51% | 35.23% |

| GÄVLE | 22.26% | 11.51% | 35.13% |

| SANDVIKEN | 21.61% | 11.51% | 34.48% |

| SÖDERHAMN | 21.66% | 11.51% | 34.53% |

| BOLLNÄS | 21.86% | 11.51% | 34.73% |

| HUDIKSVALL | 21.61% | 11.51% | 34.48% |

| ÅNGE | 23.33% | 11.29% | 36.33% |

| TIMRÅ | 23.09% | 11.29% | 36.09% |

| HÄRNÖSAND | 23.34% | 11.29% | 36.34% |

| SUNDSVALL | 22.59% | 11.29% | 35.59% |

| KRAMFORS | 23.14% | 11.29% | 36.14% |

| SOLLEFTEÅ | 23.39% | 11.29% | 36.39% |

| ÖRNSKÖLDSVIK | 22.56% | 11.29% | 35.56% |

| RAGUNDA | 23.22% | 11.7% | 36.61% |

| BRÄCKE | 23.39% | 11.7% | 36.78% |

| KROKOM | 22.17% | 11.7% | 35.56% |

| STRÖMSUND | 23.22% | 11.7% | 36.61% |

| ÅRE | 22.22% | 11.7% | 35.61% |

| BERG | 22.52% | 11.7% | 35.91% |

| HÄRJEDALEN | 22.47% | 11.7% | 35.86% |

| ÖSTERSUND | 22.02% | 11.7% | 35.41% |

| NORDMALING | 23.25% | 11.85% | 36.49% |

| BJURHOLM | 23.15% | 11.85% | 36.39% |

| VINDELN | 23.35% | 11.85% | 36.59% |

| ROBERTSFORS | 23.15% | 11.85% | 36.39% |

| NORSJÖ | 23.35% | 11.85% | 36.59% |

| MALÅ | 23.35% | 11.85% | 36.59% |

| STORUMAN | 23.1% | 11.85% | 36.34% |

| SORSELE | 23.6% | 11.85% | 36.84% |

| DOROTEA | 23.8% | 11.85% | 37.04% |

| VÄNNÄS | 23.35% | 11.85% | 36.59% |

| VILHELMINA | 23.65% | 11.85% | 36.89% |

| ÅSELE | 23.6% | 11.85% | 36.84% |

| UMEÅ | 22.8% | 11.85% | 36.04% |

| LYCKSELE | 23.05% | 11.85% | 36.29% |

| SKELLEFTEÅ | 22.6% | 11.85% | 35.84% |

| ARVIDSJAUR | 22.8% | 11.34% | 35.43% |

| ARJEPLOG | 23.5% | 11.34% | 36.13% |

| JOKKMOKK | 22.95% | 11.34% | 35.58% |

| ÖVERKALIX | 22.8% | 11.34% | 35.43% |

| KALIX | 22.55% | 11.34% | 35.18% |

| ÖVERTORNEÅ | 22.5% | 11.34% | 35.13% |

| PAJALA | 23.4% | 11.34% | 36.03% |

| GÄLLIVARE | 22.55% | 11.34% | 35.18% |

| ÄLVSBYN | 22.45% | 11.34% | 35.08% |

| LULEÅ | 22.5% | 11.34% | 35.13% |

| PITEÅ | 22.25% | 11.34% | 34.88% |

| BODEN | 22.6% | 11.34% | 35.23% |

| HAPARANDA | 22.5% | 11.34% | 35.13% |

| KIRUNA | 23.05% | 11.34% | 35.68% |