Calculate Swedish Tax / Net Salary in Lessebo municipality

- Home

- Calculate Take-Home Pay, Net Salary

Lessebo Municipality – facts, statistics, and insights

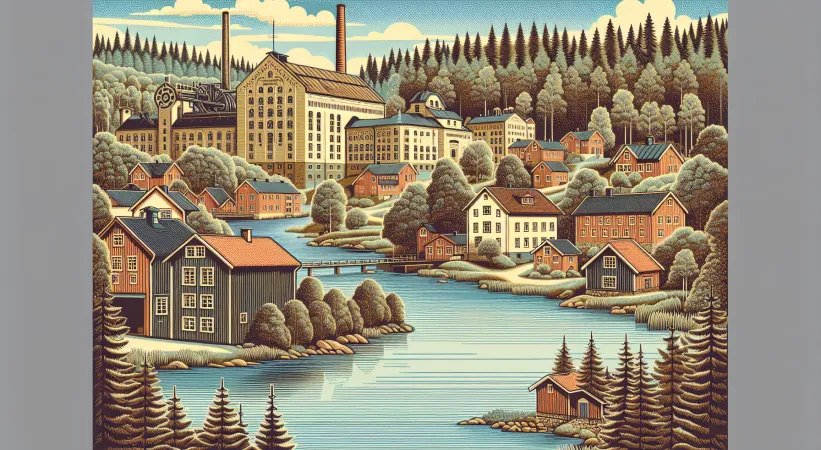

Lessebo Municipality is located in the heart of the Småland glass kingdom and is a place where tradition meets optimism for the future. With a history strongly influenced by the paper and glass industries, and a natural setting among lakes and forests, Lessebo offers both small-town life and outdoor recreation opportunities. The municipality may be smaller in size and population, but it is full of engagement, closeness, and initiative.

Population and Demographics

Lessebo is one of the smaller municipalities in Kronoberg County, with a population characterized by both tradition and diversity. The population is around 8,500, with a relatively even distribution between urban and rural areas. Over the past decades, the municipality has seen an influx of new Swedes, contributing to an exciting mix of cultures and languages. The age structure is varied – with many older residents and a growing proportion of younger families, which influences schools, care services, and leisure activities.

It is striking how Lessebo, despite its modest size, has managed to be a driver of integration and community – this is evident in both schools and associations.

Taxes, Welfare, and Municipal Services

Lessebo has a municipal tax rate of 21.81%. Together with the county council tax of 12% and a funeral fee of 0.29%, the total tax burden is 33.81% – the church fee applies to members of the Church of Sweden (1.46%). Tax revenues are used to finance schools, eldercare, childcare, and other welfare services. Despite challenges with a smaller tax base, the municipality focuses on proximity in services and the ability to quickly get help, whether it concerns healthcare, education, or support for families with children.

- Municipal tax: 21.81%

- County council tax: 12%

- Funeral fee: 0.29%

- Church fee: 1.46% (for members)

The challenges are clear – an aging population, greater care needs, and increased demands for integration. But Lessebo also benefits from short decision paths and local engagement, allowing resources to be used efficiently and flexibly.

Economy and Job Market

Historically, Lessebo has been heavily dependent on industry, especially the paper mill and glass industry. Today, these sectors remain important employers, but the municipality has also worked to diversify the job market. Small businesses, retail, and the public sector account for a growing share of jobs. Unemployment has varied, but Lessebo has shown resilience and the ability to attract new entrepreneurs, often linked to traditional crafts or environmental technology. Many commute to Växjö or Emmaboda for work, but the municipality actively works to create more local employment opportunities.

Education and Business

The municipality offers both primary and secondary schools, with a focus on enabling young people to stay and develop. Proximity to Linnaeus University in Växjö and vocational colleges makes further education accessible. Lessebo is also known for its entrepreneurship in glass and paper – Lessebo Hand Paper Mill is one of the oldest and most renowned in the country. The business climate is characterized by short distances to decision-makers and a willingness to collaborate across borders.

Geography and Attractions

Lessebo is located between Växjö and Kalmar, and is part of the world-famous Glass Kingdom. Here, you can enjoy beautiful lakes, deep forests, and a rich outdoor life. Both Hovmantorp and Kosta attract visitors with their glassworks, and Lessebo Mill is a must for those interested in cultural history. Nature reserves, cycling trails, and small beaches make the municipality attractive for residents and tourists alike. A little tip: don’t miss the opportunity to try paper-making or glassblowing – it’s a craft you won’t forget!

FAQ about Lessebo Municipality

- What is the municipal tax rate in Lessebo?

The municipal tax rate is 21.81%. The total tax burden excluding church fee is 33.81%. - What is Lessebo known for?

Primarily for its paper industry and as part of the Glass Kingdom, with several historic mills and workshops. - How is the job market?

Industry is dominant, but the municipality also invests in small businesses and environmental technology. Many commute to nearby cities. - What attractions are there?

Lessebo Hand Paper Mill, Kosta Glassworks, beautiful lakes and nature reserves are some of the highlights.

-

The employer pays

Total cost to the employer

52 305 kr -

Employer fee

This is a fee your employer pays

-12 505 kr -

Your gross salary

This is your salary before deductions, taxes, and fees.

= 39 800 kr -

Basic Allowance

A deduction that lowers taxable income.

-1 442 kr -

Taxable income

This is what taxes and fees are calculated on

=38 358 kr -

Employment tax credit

A tax reduction on earned income, intended to increase work incentives by reducing the tax burden.

+3 009 kr -

Municipal tax

The municipal tax in Lessebo är 21.81%

-8 366 kr -

County tax

The tax in your county is 12%

-4 603 kr -

State income tax

An extra 20 percent tax is levied on income above that 540 700 kr per year

-0 kr -

Church fee

If you are a member of the Church of Sweden, you also pay church fees

-0 kr -

Burial fee

A mandatory fee charged by Lessebo stift (i din kommun) 0.29%

-100 kr -

Your net salary

This is what you get to keep after taxes and fees

29 740 kr -

Taxes & Fees

This is what you and the employer paid in total in taxes and fees

22 565 kr

-

The employer pays

Total cost to the employer

52 305 kr -

Employer fee

This is a fee your employer pays

-12 505 kr -

Your gross salary

This is your salary before deductions, taxes, and fees.

= 39 800 kr -

Basic Allowance

A deduction that lowers taxable income.

-1 442 kr -

Taxable income

This is what taxes and fees are calculated on

=38 358 kr -

Employment tax credit

A tax reduction on earned income, intended to increase work incentives by reducing the tax burden.

+3 313 kr -

Municipal tax

The municipal tax in Lessebo är 21.81%

-8 366 kr -

County tax

The tax in your county is 12%

-4 603 kr -

State income tax

An extra 20 percent tax is levied on income above that 598 500 kr per year

-0 kr -

Church fee

If you are a member of the Church of Sweden, you also pay church fees

-0 kr -

Burial fee

A mandatory fee charged by Lessebo stift (i din kommun) 0.29%

-100 kr -

Your net salary

This is what you get to keep after taxes and fees

30 044 kr -

Taxes & Fees

This is what you and the employer paid in total in taxes and fees

22 261 kr

-

The employer pays

Total cost to the employer

52 305 kr -

Employer fee

This is a fee your employer pays

-12 505 kr -

Your gross salary

This is your salary before deductions, taxes, and fees.

= 39 800 kr -

Basic Allowance

A deduction that lowers taxable income.

-1 442 kr -

Taxable income

This is what taxes and fees are calculated on

=38 358 kr -

Employment tax credit

A tax reduction on earned income, intended to increase work incentives by reducing the tax burden.

+3 747 kr -

Municipal tax

The municipal tax in Lessebo är 21.81%

-8 366 kr -

County tax

The tax in your county is 12%

-4 603 kr -

State income tax

An extra 20 percent tax is levied on income above that 598 500 kr per year

-0 kr -

Church fee

If you are a member of the Church of Sweden, you also pay church fees

-0 kr -

Burial fee

A mandatory fee charged by Lessebo stift (i din kommun) 0.29%

-107 kr -

Your net salary

This is what you get to keep after taxes and fees

30 471 kr -

Taxes & Fees

This is what you and the employer paid in total in taxes and fees

21 835 kr

-

The employer pays

Total cost to the employer

52 305 kr -

Employer fee

This is a fee your employer pays

-12 505 kr -

Your gross salary

This is your salary before deductions, taxes, and fees.

= 39 800 kr -

Basic Allowance

A deduction that lowers taxable income.

-1 442 kr -

Taxable income

This is what taxes and fees are calculated on

=38 358 kr -

Employment tax credit

A tax reduction on earned income, intended to increase work incentives by reducing the tax burden.

+3 747 kr -

Municipal tax

The municipal tax in Lessebo är 21.81%

-8 366 kr -

County tax

The tax in your county is 12%

-4 603 kr -

State income tax

An extra 20 percent tax is levied on income above that 625 800 kr per year

-0 kr -

Church fee

If you are a member of the Church of Sweden, you also pay church fees

-0 kr -

Burial fee

A mandatory fee charged by Lessebo stift (i din kommun) 0.29%

-111 kr -

Your net salary

This is what you get to keep after taxes and fees

30 467 kr -

Taxes & Fees

This is what you and the employer paid in total in taxes and fees

21 838 kr

-

The employer pays

Total cost to the employer

52 305 kr -

Employer fee

This is a fee your employer pays

-12 505 kr -

Your gross salary

This is your salary before deductions, taxes, and fees.

= 39 800 kr -

Basic Allowance

A deduction that lowers taxable income.

-1 442 kr -

Taxable income

This is what taxes and fees are calculated on

=38 358 kr -

Employment tax credit

A tax reduction on earned income, intended to increase work incentives by reducing the tax burden.

+3 747 kr -

Municipal tax

The municipal tax in Lessebo är 21.81%

-8 366 kr -

County tax

The tax in your county is 12%

-4 603 kr -

State income tax

An extra 20 percent tax is levied on income above that 643 000 kr per year

-0 kr -

Church fee

If you are a member of the Church of Sweden, you also pay church fees

-0 kr -

Burial fee

A mandatory fee charged by Lessebo stift (i din kommun) 0.29%

-111 kr -

Your net salary

This is what you get to keep after taxes and fees

30 467 kr -

Taxes & Fees

This is what you and the employer paid in total in taxes and fees

21 838 kr

| Municipality | Municipal | County council | Total |

|---|---|---|---|

| UPPLANDS VÄSBY | 19.42% | 12.33% | 32.78% |

| VALLENTUNA | 18.9% | 12.33% | 32.26% |

| ÖSTERÅKER | 16.6% | 12.33% | 29.96% |

| VÄRMDÖ | 18.98% | 12.33% | 32.34% |

| JÄRFÄLLA | 19.19% | 12.33% | 32.55% |

| EKERÖ | 19.12% | 12.33% | 32.48% |

| HUDDINGE | 19.38% | 12.33% | 32.74% |

| BOTKYRKA | 19.9% | 12.33% | 33.26% |

| SALEM | 19.67% | 12.33% | 33.03% |

| HANINGE | 18.95% | 12.33% | 32.31% |

| TYRESÖ | 19.5% | 12.33% | 32.86% |

| UPPLANDS-BRO | 19.4% | 12.33% | 32.76% |

| NYKVARN | 19.97% | 12.33% | 33.33% |

| TÄBY | 17.55% | 12.33% | 30.91% |

| DANDERYD | 18.25% | 12.33% | 31.61% |

| SOLLENTUNA | 18.12% | 12.33% | 31.48% |

| STOCKHOLM | 18.22% | 12.33% | 31.58% |

| SÖDERTÄLJE | 20.05% | 12.33% | 33.41% |

| NACKA | 17.78% | 12.33% | 31.14% |

| SUNDBYBERG | 19.25% | 12.33% | 32.61% |

| SOLNA | 17.37% | 12.33% | 30.73% |

| LIDINGÖ | 17.34% | 12.33% | 30.7% |

| VAXHOLM | 19.3% | 12.33% | 32.66% |

| NORRTÄLJE | 19.72% | 12.33% | 33.08% |

| SIGTUNA | 19.5% | 12.33% | 32.86% |

| NYNÄSHAMN | 19.85% | 12.33% | 33.21% |

| HÅBO | 21.59% | 11.71% | 34.69% |

| ÄLVKARLEBY | 22.69% | 11.71% | 35.79% |

| KNIVSTA | 20.91% | 11.71% | 34.01% |

| HEBY | 22.5% | 11.71% | 35.6% |

| TIERP | 21.29% | 11.71% | 34.39% |

| UPPSALA | 21.14% | 11.71% | 34.24% |

| ENKÖPING | 21.34% | 11.71% | 34.44% |

| ÖSTHAMMAR | 21.59% | 11.71% | 34.69% |

| VINGÅKER | 22.67% | 10.83% | 34.91% |

| GNESTA | 22.12% | 10.83% | 34.36% |

| NYKÖPING | 21.42% | 10.83% | 33.66% |

| OXELÖSUND | 22.22% | 10.83% | 34.46% |

| FLEN | 22.27% | 10.83% | 34.51% |

| KATRINEHOLM | 22.12% | 10.83% | 34.36% |

| ESKILSTUNA | 22.02% | 10.83% | 34.26% |

| STRÄNGNÄS | 21.67% | 10.83% | 33.91% |

| TROSA | 21.2% | 10.83% | 33.44% |

| ÖDESHÖG | 22.4% | 11.55% | 35.37% |

| YDRE | 22.55% | 11.55% | 35.52% |

| KINDA | 21.45% | 11.55% | 34.42% |

| BOXHOLM | 21.82% | 11.55% | 34.79% |

| ÅTVIDABERG | 22.39% | 11.55% | 35.36% |

| FINSPÅNG | 22.15% | 11.55% | 35.12% |

| VALDEMARSVIK | 22.48% | 11.55% | 35.45% |

| LINKÖPING | 20.2% | 11.55% | 33.17% |

| NORRKÖPING | 21.75% | 11.55% | 34.72% |

| SÖDERKÖPING | 21.98% | 11.55% | 34.95% |

| MOTALA | 21.7% | 11.55% | 34.67% |

| VADSTENA | 22.8% | 11.55% | 35.77% |

| MJÖLBY | 21.9% | 11.55% | 34.87% |

| ANEBY | 22.09% | 11.76% | 35.32% |

| GNOSJÖ | 22.24% | 11.76% | 35.47% |

| MULLSJÖ | 22.34% | 11.76% | 35.57% |

| HABO | 22.17% | 11.76% | 35.4% |

| GISLAVED | 21.99% | 11.76% | 35.22% |

| VAGGERYD | 21.49% | 11.76% | 34.72% |

| JÖNKÖPING | 21.64% | 11.76% | 34.87% |

| NÄSSJÖ | 22.54% | 11.76% | 35.77% |

| VÄRNAMO | 21.52% | 11.76% | 34.75% |

| SÄVSJÖ | 21.92% | 11.76% | 35.15% |

| VETLANDA | 22.01% | 11.76% | 35.24% |

| EKSJÖ | 22.26% | 11.76% | 35.49% |

| TRANÅS | 22.01% | 11.76% | 35.24% |

| UPPVIDINGE | 21.8% | 12% | 35.26% |

| LESSEBO | 21.81% | 12% | 35.27% |

| TINGSRYD | 22% | 12% | 35.46% |

| ALVESTA | 21.42% | 12% | 34.88% |

| ÄLMHULT | 21.86% | 12% | 35.32% |

| MARKARYD | 21.31% | 12% | 34.77% |

| VÄXJÖ | 20.19% | 12% | 33.65% |

| LJUNGBY | 21.07% | 12% | 34.53% |

| HÖGSBY | 22.21% | 11.86% | 35.62% |

| TORSÅS | 21.93% | 11.86% | 35.34% |

| MÖRBYLÅNGA | 22.21% | 11.86% | 35.62% |

| HULTSFRED | 21.91% | 11.86% | 35.32% |

| MÖNSTERÅS | 22.21% | 11.86% | 35.62% |

| EMMABODA | 21.96% | 11.86% | 35.37% |

| KALMAR | 21.81% | 11.86% | 35.22% |

| NYBRO | 22.33% | 11.86% | 35.74% |

| OSKARSHAMN | 22.35% | 11.86% | 35.76% |

| VÄSTERVIK | 21.16% | 11.86% | 34.57% |

| VIMMERBY | 22.36% | 11.86% | 35.77% |

| BORGHOLM | 21.58% | 11.86% | 34.99% |

| GOTLAND | 33.6% | 0% | 35.5% |

| OLOFSTRÖM | 21.71% | 12.04% | 35.09% |

| KARLSKRONA | 21.65% | 12.04% | 35.03% |

| RONNEBY | 21.64% | 12.04% | 35.02% |

| KARLSHAMN | 21.76% | 12.04% | 35.14% |

| SÖLVESBORG | 21.82% | 12.04% | 35.2% |

| SVALÖV | 20.74% | 11.18% | 33.26% |

| STAFFANSTORP | 18.94% | 11.18% | 31.46% |

| BURLÖV | 20.09% | 11.18% | 32.61% |

| VELLINGE | 18.5% | 11.18% | 31.02% |

| ÖSTRA GÖINGE | 20.99% | 11.18% | 33.51% |

| ÖRKELLJUNGA | 19.06% | 11.18% | 31.58% |

| BJUV | 20.99% | 11.18% | 33.51% |

| KÄVLINGE | 18.41% | 11.18% | 30.93% |

| LOMMA | 19.54% | 11.18% | 32.06% |

| SVEDALA | 20.24% | 11.18% | 32.76% |

| SKURUP | 20.42% | 11.18% | 32.94% |

| SJÖBO | 20.92% | 11.18% | 33.44% |

| HÖRBY | 21.08% | 11.18% | 33.6% |

| HÖÖR | 21.45% | 11.18% | 33.97% |

| TOMELILLA | 20.61% | 11.18% | 33.13% |

| BROMÖLLA | 22.56% | 11.18% | 35.08% |

| OSBY | 22.81% | 11.18% | 35.33% |

| PERSTORP | 20.81% | 11.18% | 33.33% |

| KLIPPAN | 20.75% | 11.18% | 33.27% |

| ÅSTORP | 20.29% | 11.18% | 32.81% |

| BÅSTAD | 20.23% | 11.18% | 32.75% |

| MALMÖ | 21.24% | 11.18% | 33.76% |

| LUND | 21.24% | 11.18% | 33.76% |

| LANDSKRONA | 20.24% | 11.18% | 32.76% |

| HELSINGBORG | 20.21% | 11.18% | 32.73% |

| HÖGANÄS | 19.73% | 11.18% | 32.25% |

| ESLÖV | 20.54% | 11.18% | 33.06% |

| YSTAD | 20.11% | 11.18% | 32.63% |

| TRELLEBORG | 20.4% | 11.18% | 32.92% |

| KRISTIANSTAD | 21.46% | 11.18% | 33.98% |

| SIMRISHAMN | 20.51% | 11.18% | 33.03% |

| ÄNGELHOLM | 20.17% | 11.18% | 32.69% |

| HÄSSLEHOLM | 21.2% | 11.18% | 33.72% |

| HYLTE | 22.45% | 11.4% | 35.32% |

| HALMSTAD | 20.98% | 11.4% | 33.85% |

| LAHOLM | 21.4% | 11.4% | 34.27% |

| FALKENBERG | 21.1% | 11.4% | 33.97% |

| VARBERG | 20.33% | 11.4% | 33.2% |

| KUNGSBACKA | 21.18% | 11.4% | 34.05% |

| HÄRRYDA | 20.5% | 11.48% | 33.35% |

| PARTILLE | 19.88% | 11.48% | 32.73% |

| ÖCKERÖ | 21.56% | 11.48% | 34.41% |

| STENUNGSUND | 21.64% | 11.48% | 34.49% |

| TJÖRN | 21.71% | 11.48% | 34.56% |

| ORUST | 22.21% | 11.48% | 35.06% |

| SOTENÄS | 21.99% | 11.48% | 34.84% |

| MUNKEDAL | 23.38% | 11.48% | 36.23% |

| TANUM | 21.56% | 11.48% | 34.41% |

| DALS-ED | 23.21% | 11.48% | 36.06% |

| FÄRGELANDA | 22.91% | 11.48% | 35.76% |

| ALE | 21.32% | 11.48% | 34.17% |

| LERUM | 20.55% | 11.48% | 33.4% |

| VÅRGÅRDA | 21.61% | 11.48% | 34.46% |

| BOLLEBYGD | 21.59% | 11.48% | 34.44% |

| GRÄSTORP | 21.99% | 11.48% | 34.84% |

| ESSUNGA | 21.57% | 11.48% | 34.42% |

| KARLSBORG | 21.32% | 11.48% | 34.17% |

| GULLSPÅNG | 22.49% | 11.48% | 35.34% |

| TRANEMO | 21.5% | 11.48% | 34.35% |

| BENGTSFORS | 22.92% | 11.48% | 35.77% |

| MELLERUD | 22.6% | 11.48% | 35.45% |

| LILLA EDET | 22.37% | 11.48% | 35.22% |

| MARK | 21.51% | 11.48% | 34.36% |

| SVENLJUNGA | 22.05% | 11.48% | 34.9% |

| HERRLJUNGA | 22.14% | 11.48% | 34.99% |

| VARA | 21.77% | 11.48% | 34.62% |

| GÖTENE | 22.12% | 11.48% | 34.97% |

| TIBRO | 21.71% | 11.48% | 34.56% |

| TÖREBODA | 21.72% | 11.48% | 34.57% |

| GÖTEBORG | 21.12% | 11.48% | 33.97% |

| MÖLNDAL | 20.51% | 11.48% | 33.36% |

| KUNGÄLV | 21.44% | 11.48% | 34.29% |

| LYSEKIL | 22.46% | 11.48% | 35.31% |

| UDDEVALLA | 22.16% | 11.48% | 35.01% |

| STRÖMSTAD | 21.91% | 11.48% | 34.76% |

| VÄNERSBORG | 22.21% | 11.48% | 35.06% |

| TROLLHÄTTAN | 22.36% | 11.48% | 35.21% |

| ALINGSÅS | 21.36% | 11.48% | 34.21% |

| BORÅS | 21.31% | 11.48% | 34.16% |

| ULRICEHAMN | 21.05% | 11.48% | 33.9% |

| ÅMÅL | 22.46% | 11.48% | 35.31% |

| MARIESTAD | 21.26% | 11.48% | 34.11% |

| LIDKÖPING | 21.26% | 11.48% | 34.11% |

| SKARA | 21.9% | 11.48% | 34.75% |

| SKÖVDE | 21.61% | 11.48% | 34.46% |

| HJO | 22% | 11.48% | 34.85% |

| TIDAHOLM | 22.07% | 11.48% | 34.92% |

| FALKÖPING | 21.95% | 11.48% | 34.8% |

| KIL | 22.35% | 12.28% | 36.06% |

| EDA | 22.27% | 12.28% | 35.98% |

| TORSBY | 22.02% | 12.28% | 35.73% |

| STORFORS | 22.7% | 12.28% | 36.41% |

| HAMMARÖ | 22.77% | 12.28% | 36.48% |

| MUNKFORS | 22.02% | 12.28% | 35.73% |

| FORSHAGA | 22.35% | 12.28% | 36.06% |

| GRUMS | 22.5% | 12.28% | 36.21% |

| ÅRJÄNG | 21.97% | 12.28% | 35.68% |

| SUNNE | 21.47% | 12.28% | 35.18% |

| KARLSTAD | 21.27% | 12.28% | 34.98% |

| KRISTINEHAMN | 21.97% | 12.28% | 35.68% |

| FILIPSTAD | 22.27% | 12.28% | 35.98% |

| HAGFORS | 22.02% | 12.28% | 35.73% |

| ARVIKA | 21.75% | 12.28% | 35.46% |

| SÄFFLE | 21.52% | 12.28% | 35.23% |

| LEKEBERG | 21.43% | 12.3% | 35.08% |

| LAXÅ | 22.7% | 12.3% | 36.35% |

| HALLSBERG | 21.55% | 12.3% | 35.2% |

| DEGERFORS | 23% | 12.3% | 36.65% |

| HÄLLEFORS | 22.05% | 12.3% | 35.7% |

| LJUSNARSBERG | 21.5% | 12.3% | 35.15% |

| ÖREBRO | 21.35% | 12.3% | 35% |

| KUMLA | 21.54% | 12.3% | 35.19% |

| ASKERSUND | 21.85% | 12.3% | 35.5% |

| KARLSKOGA | 22% | 12.3% | 35.65% |

| NORA | 22.25% | 12.3% | 35.9% |

| LINDESBERG | 22.3% | 12.3% | 35.95% |

| SKINNSKATTEBERG | 22.46% | 10.88% | 34.69% |

| SURAHAMMAR | 22.31% | 10.88% | 34.54% |

| KUNGSÖR | 22.03% | 10.88% | 34.26% |

| HALLSTAHAMMAR | 21.81% | 10.88% | 34.04% |

| NORBERG | 22.66% | 10.88% | 34.89% |

| VÄSTERÅS | 20.36% | 10.88% | 32.59% |

| SALA | 22.31% | 10.88% | 34.54% |

| FAGERSTA | 22.11% | 10.88% | 34.34% |

| KÖPING | 22.16% | 10.88% | 34.39% |

| ARBOGA | 22.41% | 10.88% | 34.64% |

| VANSBRO | 22.29% | 11.99% | 35.72% |

| MALUNG-SÄLEN | 22.46% | 11.99% | 35.89% |

| GAGNEF | 22.28% | 11.99% | 35.71% |

| LEKSAND | 21.81% | 11.99% | 35.24% |

| RÄTTVIK | 21.81% | 11.99% | 35.24% |

| ORSA | 22.31% | 11.99% | 35.74% |

| ÄLVDALEN | 22.78% | 11.99% | 36.21% |

| SMEDJEBACKEN | 22.45% | 11.99% | 35.88% |

| MORA | 22.33% | 11.99% | 35.76% |

| FALUN | 22.06% | 11.99% | 35.49% |

| BORLÄNGE | 22.41% | 11.99% | 35.84% |

| SÄTER | 22.31% | 11.99% | 35.74% |

| HEDEMORA | 22.16% | 11.99% | 35.59% |

| AVESTA | 21.96% | 11.99% | 35.39% |

| LUDVIKA | 22.06% | 11.99% | 35.49% |

| OCKELBO | 22.76% | 11.51% | 35.63% |

| HOFORS | 22.86% | 11.51% | 35.73% |

| OVANÅKER | 21.86% | 11.51% | 34.73% |

| NORDANSTIG | 22.51% | 11.51% | 35.38% |

| LJUSDAL | 22.36% | 11.51% | 35.23% |

| GÄVLE | 22.26% | 11.51% | 35.13% |

| SANDVIKEN | 21.61% | 11.51% | 34.48% |

| SÖDERHAMN | 21.66% | 11.51% | 34.53% |

| BOLLNÄS | 21.86% | 11.51% | 34.73% |

| HUDIKSVALL | 21.61% | 11.51% | 34.48% |

| ÅNGE | 23.33% | 11.29% | 36.33% |

| TIMRÅ | 23.09% | 11.29% | 36.09% |

| HÄRNÖSAND | 23.34% | 11.29% | 36.34% |

| SUNDSVALL | 22.59% | 11.29% | 35.59% |

| KRAMFORS | 23.14% | 11.29% | 36.14% |

| SOLLEFTEÅ | 23.39% | 11.29% | 36.39% |

| ÖRNSKÖLDSVIK | 22.56% | 11.29% | 35.56% |

| RAGUNDA | 23.22% | 11.7% | 36.61% |

| BRÄCKE | 23.39% | 11.7% | 36.78% |

| KROKOM | 22.17% | 11.7% | 35.56% |

| STRÖMSUND | 23.22% | 11.7% | 36.61% |

| ÅRE | 22.22% | 11.7% | 35.61% |

| BERG | 22.52% | 11.7% | 35.91% |

| HÄRJEDALEN | 22.47% | 11.7% | 35.86% |

| ÖSTERSUND | 22.02% | 11.7% | 35.41% |

| NORDMALING | 23.25% | 11.85% | 36.49% |

| BJURHOLM | 23.15% | 11.85% | 36.39% |

| VINDELN | 23.35% | 11.85% | 36.59% |

| ROBERTSFORS | 23.15% | 11.85% | 36.39% |

| NORSJÖ | 23.35% | 11.85% | 36.59% |

| MALÅ | 23.35% | 11.85% | 36.59% |

| STORUMAN | 23.1% | 11.85% | 36.34% |

| SORSELE | 23.6% | 11.85% | 36.84% |

| DOROTEA | 23.8% | 11.85% | 37.04% |

| VÄNNÄS | 23.35% | 11.85% | 36.59% |

| VILHELMINA | 23.65% | 11.85% | 36.89% |

| ÅSELE | 23.6% | 11.85% | 36.84% |

| UMEÅ | 22.8% | 11.85% | 36.04% |

| LYCKSELE | 23.05% | 11.85% | 36.29% |

| SKELLEFTEÅ | 22.6% | 11.85% | 35.84% |

| ARVIDSJAUR | 22.8% | 11.34% | 35.43% |

| ARJEPLOG | 23.5% | 11.34% | 36.13% |

| JOKKMOKK | 22.95% | 11.34% | 35.58% |

| ÖVERKALIX | 22.8% | 11.34% | 35.43% |

| KALIX | 22.55% | 11.34% | 35.18% |

| ÖVERTORNEÅ | 22.5% | 11.34% | 35.13% |

| PAJALA | 23.4% | 11.34% | 36.03% |

| GÄLLIVARE | 22.55% | 11.34% | 35.18% |

| ÄLVSBYN | 22.45% | 11.34% | 35.08% |

| LULEÅ | 22.5% | 11.34% | 35.13% |

| PITEÅ | 22.25% | 11.34% | 34.88% |

| BODEN | 22.6% | 11.34% | 35.23% |

| HAPARANDA | 22.5% | 11.34% | 35.13% |

| KIRUNA | 23.05% | 11.34% | 35.68% |