Municipality

- Articles

- Municipality

Tax Burden in Orust Municipality

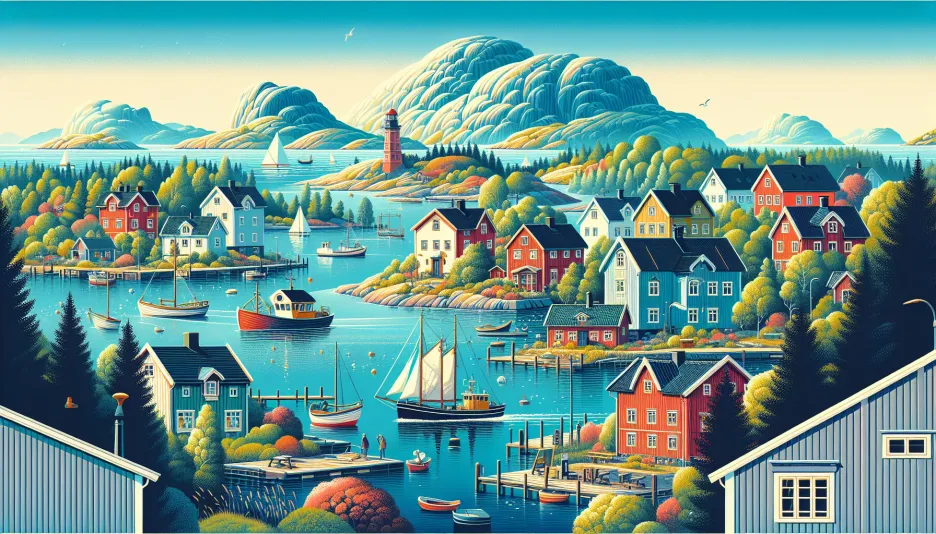

Orust Municipality is a picturesque municipality located in Västra Götaland County. With a municipal tax rate of 22.46%, county tax of 11.48%, and a burial fee of 0.28%, the total tax burden amounts to 33.94% excluding the church fee. For members of the Swedish Church, an additional church fee of 1.35% applies, bringing the total tax burden to 35.29%.

Use of Tax Revenues

Tax revenues in Orust Municipality are primarily used to finance essential community functions and services. A significant portion of the budget goes towards education, healthcare, and infrastructure. The municipality also invests in culture and leisure, including libraries, sports facilities, and various cultural events. Additionally, some tax revenues are allocated to improving the municipality's environment and sustainability.

Economic Challenges and Opportunities

Orust Municipality faces several economic challenges. An aging population entails increased costs for healthcare, while also demanding the maintenance and enhancement of service quality. Furthermore, there is a need to invest in infrastructure and housing construction to meet future needs.

At the same time, there are opportunities. The municipality has a strong tourism sector thanks to its scenic location and rich cultural heritage, which can generate income and create employment opportunities. Moreover, there is potential to develop the business sector and attract more companies to the area, which could contribute to an expanded tax base.

Standard of Living and Quality

Orust Municipality offers a high standard of living with good access to both public and private services. The schools maintain high quality, and there is a wide range of recreational activities for both children and adults. The municipality also has a well-developed healthcare and social care system that ensures residents receive the assistance they need.

The scenic environment and proximity to the sea contribute to a high quality of life for the municipality's residents. There are ample opportunities for outdoor activities and recreation, making Orust an attractive place to live.

Effects on Individuals' Finances

The tax burden in Orust Municipality naturally affects individuals' finances. With a total tax rate of 33.94% excluding the church fee, or 35.29% including the church fee, a significant portion of income goes towards taxes. This can impact how much money remains in the wallet after tax, which in turn can influence spending patterns and savings.

To gain a better understanding of how much tax you pay and how much you have left after tax, we recommend using our tax calculator. By entering your gross salary, you can easily calculate your net salary and gain a clearer picture of your financial situation.

In summary, Orust Municipality offers a high standard of living and good quality of public services, but also faces economic challenges that require wise investments and strategic decisions. The tax burden is relatively high, affecting individuals' finances, but it also contributes to financing essential community functions that make the municipality an attractive place to live in.

Sweden's national debt

-

Municipality

MunicipalityTax Pressure in Kiruna Municipality - An Overview of Tax Rates and Economic Challenges

Thu, 23 May 2024 - 22:26

-

Municipality

MunicipalityTax Pressure in Kiruna Municipality Kiruna Municipality, located in the northernmost part of Swede

Thu, 23 May 2024 - 20:26 -

Municipality

MunicipalityTax Burden in Haparanda Municipality Haparanda municipality, located on the border with Finland, is

Thu, 23 May 2024 - 20:25 -

Municipality

MunicipalityTax Burden in Boden Municipality Boden Municipality is located in Norrbotten County and is known f

Thu, 23 May 2024 - 20:25 -

Municipality

MunicipalityTax Burden in Piteå Municipality Piteå Municipality, located in Norrbotten County, is known for i

Thu, 23 May 2024 - 20:24 - Show more ->