Municipality

- Articles

- Municipality

Tax Burden in Piteå Municipality

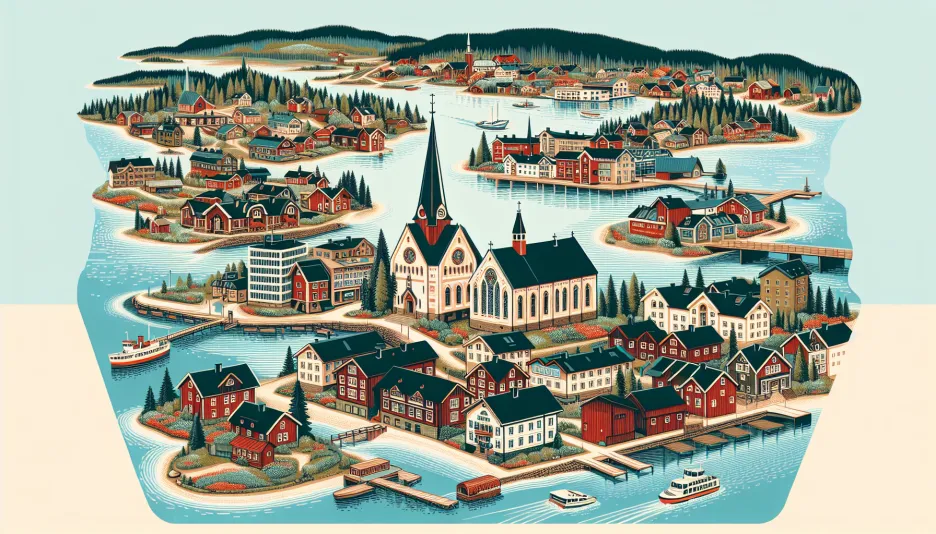

Piteå Municipality, located in Norrbotten County, is known for its beautiful nature and strong local community. An important aspect of life in Piteå is the tax burden, which affects both individuals' finances and the municipality's ability to provide services and infrastructure. In this article, we will discuss municipal taxes, how tax revenues are used, as well as the economic challenges and opportunities facing the municipality.

Municipal Taxes in Piteå

The tax rate in Piteå Municipality consists of several components:

- Municipal tax: 22.25%

- County council tax: 11.34%

- Funeral fee: 0.28%

- Church fee (for members): 1.27%

The total tax burden excluding the church fee is 33.59%. For members of the Swedish Church, the total tax burden amounts to 34.86%.

Use of Tax Revenues

Tax revenues in Piteå Municipality are used to finance a variety of public services and infrastructure projects. Here are some of the key areas:

- Education: A significant portion of tax revenues goes to schools and educational institutions to ensure high-quality teaching.

- Healthcare and social care: The municipality invests in providing good healthcare and social care for the elderly and people with disabilities.

- Infrastructure: Maintenance and development of roads, parks, and public buildings are also prioritized areas.

- Culture and recreation: Piteå invests in cultural and recreational activities to enhance residents' quality of life.

Economic Challenges and Opportunities

Piteå Municipality faces several economic challenges, such as an aging population and the need to maintain and improve infrastructure. However, there are also opportunities, especially in areas like tourism and renewable energy.

One of the biggest challenges is to balance the budget without further tax increases, which can be difficult with rising costs for healthcare and social care. On the other hand, Piteå has the potential to leverage its beautiful nature and attractive location to attract tourists and new residents, which can increase tax revenues.

Standard of Living and Quality

The standard of living in Piteå is generally high, with good access to education, healthcare, and recreational activities. The quality of the municipality's services is an important factor contributing to residents' well-being. Despite the economic challenges, the municipality actively works to improve the quality of life for its residents.

Effects on Individuals' Finances

The tax burden in Piteå naturally affects how much money residents have left in their wallets after taxes. With a total tax burden of 33.59% (34.86% for church members), it may feel like a significant portion of income goes to taxes. This can impact consumption patterns and savings.

To get a clearer picture of how taxes affect your finances, you can use our tax calculator to calculate your net salary based on your gross salary.

Overall, the tax burden in Piteå is an important factor that affects both the municipality's ability to provide services and residents' financial situation. By balancing tax revenues and expenditures efficiently, the municipality can continue to offer a high quality of life for its residents.

Sweden's national debt

-

Opinion Poll: Demoskop February 2026 – Center increases, S still largest

Fri, 27 Feb 2026 - 09:35 -

Policy rate remains at 1.75% – Riksbank signals stability

Thu, 29 Jan 2026 - 14:02