Municipality

- Articles

- Municipality

Tax Burden in Surahammar Municipality

Surahammar Municipality has a total municipal tax rate of 33.19% excluding the church fee. This tax rate includes the municipal tax of 22.31%, county council tax of 10.88%, and funeral fee of 0.28%. For those who are members of the Swedish Church, an additional church fee of 1.33% applies, making the total tax burden for these individuals 34.52%.

Use of Tax Revenues

Tax revenues in Surahammar Municipality are used to finance a variety of services and activities that are essential for the residents of the municipality. A significant portion of the tax revenues goes towards education, healthcare, and infrastructure. The municipality also invests in culture and recreation to enhance the quality of life for its residents.

A substantial part of the budget is allocated to elderly care and social services, ensuring that the most vulnerable groups in society receive the support they need. Education also receives a significant share of the funding, which is crucial for securing a bright future for the younger generations of the municipality.

Economic Challenges and Opportunities

Surahammar Municipality faces several economic challenges. One of the biggest challenges is to balance the budget while maintaining a high quality of services. The municipality has a relatively aging population, leading to increased costs for elderly care and healthcare.

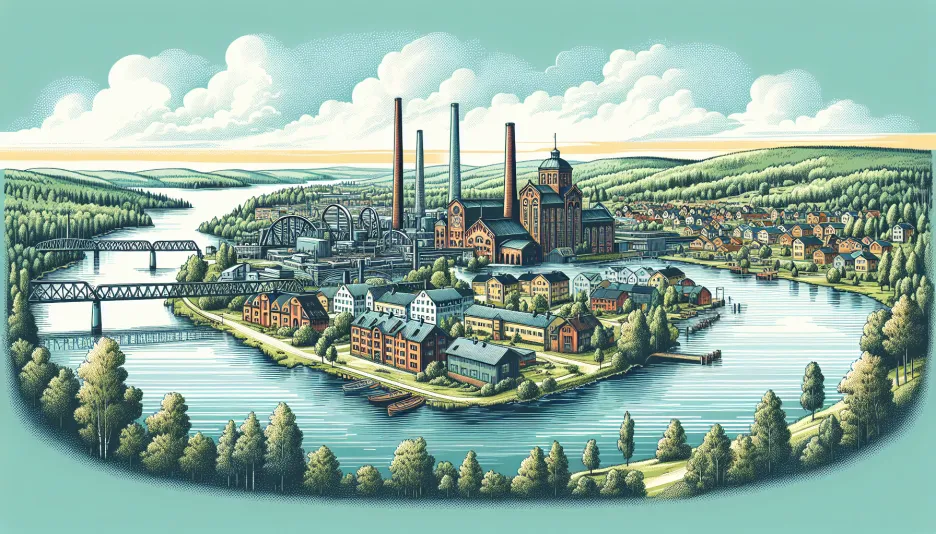

On the other hand, there are also economic opportunities. Surahammar has the potential to develop its tourism sector and leverage its scenic environment and rich cultural heritage. By investing in sustainable development and renewable energy, the municipality can create new job opportunities and attract investments.

Standard of Living and Quality

The standard of living in Surahammar is generally high. The municipality offers a safe and secure environment with good access to public services. The schools maintain a high standard, and there are plenty of recreational activities for both young and old residents.

The quality of healthcare and social services is high, although there are challenges in meeting the increasing demand from an aging population. The infrastructure and public transport system work well, making it easy for residents to commute to and from work.

Effects on Individuals' Finances

The tax burden in Surahammar naturally affects residents' finances. With a total tax rate of 33.19% excluding the church fee, a significant portion of income goes towards taxes. For those who are members of the Swedish Church, the tax burden is even higher, resulting in less disposable income.

This can impact consumption patterns and savings, emphasizing the importance for residents to plan their finances carefully. To get a better understanding of the take-home pay after taxes, individuals can use our tax calculator to calculate the net salary based on the gross income provided.

In conclusion, Surahammar Municipality has a relatively high tax burden, but this also contributes to funding important services and activities that enhance the quality of life for residents. While economic challenges exist, there are also opportunities that can contribute to a sustainable and positive development for the municipality.

Sweden's national debt

-

Opinion Poll: Demoskop February 2026 – Center increases, S still largest

Fri, 27 Feb 2026 - 09:35 -

Policy rate remains at 1.75% – Riksbank signals stability

Thu, 29 Jan 2026 - 14:02