Municipality

- Articles

- Municipality

Tax Burden in Hjo Municipality

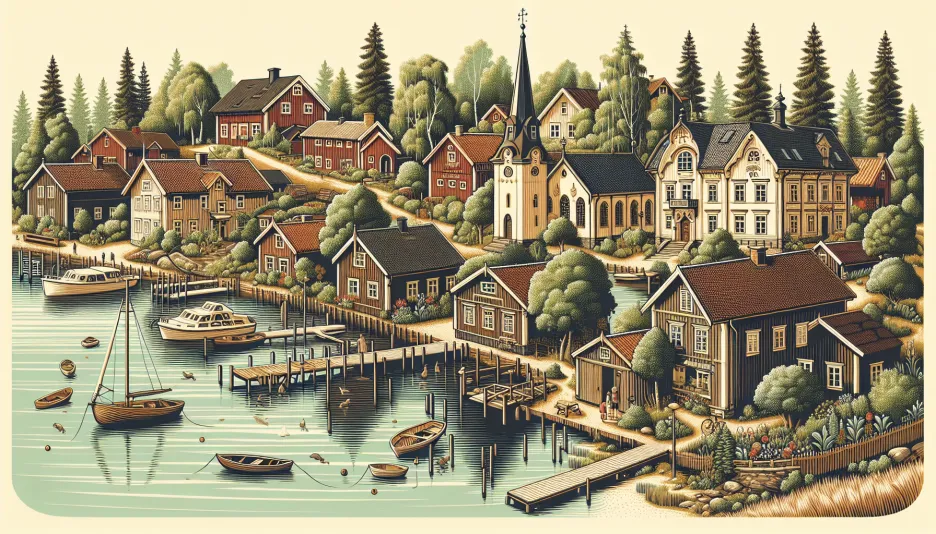

Hjo Municipality, located on the western shore of Lake Vättern, has a total tax burden of 33.48% excluding the church fee. The municipal tax is 22%, the county tax is 11.48%, and the burial fee is 0.28%. For members of the Swedish Church, an additional church fee of 1.35% applies, making the total tax rate 34.83%.

How Tax Revenues are Utilized

Tax revenues in Hjo Municipality are used to finance a range of essential services and functions. A significant portion goes towards education and childcare, including schools, preschools, and after-school care. Social services, which encompass elderly care, support for people with disabilities, and social assistance for vulnerable groups, are another significant allocation. Additionally, tax revenues finance the municipality's infrastructure, such as roads, parks, waste management, as well as cultural and recreational activities.

Economic Challenges and Opportunities

Hjo Municipality faces several economic challenges. An aging population entails increased costs for elderly care and healthcare. Meanwhile, the tax base diminishes as younger people move to larger cities for work and studies. This creates an imbalance between revenues and expenditures that the municipality must address.

Despite these challenges, there are also opportunities. Hjo has the potential to leverage its scenic environment and attractive location by Lake Vättern to attract tourists and new residents. By investing in sustainable tourism and developing local industries, the municipality can create new jobs and boost tax revenues.

Quality of Life and Community Standards

The quality of life in Hjo is generally high. The municipality offers a safe and nature-oriented environment with ample opportunities for outdoor activities and recreation. Schools and healthcare facilities maintain high standards, and there is a rich array of cultural and recreational activities.

However, the high tax burden may impact individuals' finances. With a total tax rate of 33.48% excluding the church fee, households have less disposable income. This can affect consumption patterns and savings, which in turn may have repercussions on the local economy.

Reflection on Individuals' Finances

For individuals in Hjo, the high tax burden means a significant portion of their income goes towards taxes. This can influence the amount of money available for consumption, savings, and investments. To get a clear picture of how much remains in your wallet after taxes, you can use our tax calculator. The tool helps you calculate your net salary based on your gross income and provides a clear overview of your financial situation.

In conclusion, Hjo Municipality offers a good standard of living and high quality of municipal services, but the high tax burden may impact individuals' finances. By addressing economic challenges and seizing existing opportunities, the municipality can continue to evolve and provide an attractive environment for its residents.

Sweden's national debt

-

Municipality

MunicipalityTax Pressure in Kiruna Municipality - An Overview of Tax Rates and Economic Challenges

Thu, 23 May 2024 - 22:26

-

Municipality

MunicipalityTax Pressure in Kiruna Municipality Kiruna Municipality, located in the northernmost part of Swede

Thu, 23 May 2024 - 20:26 -

Municipality

MunicipalityTax Burden in Haparanda Municipality Haparanda municipality, located on the border with Finland, is

Thu, 23 May 2024 - 20:25 -

Municipality

MunicipalityTax Burden in Boden Municipality Boden Municipality is located in Norrbotten County and is known f

Thu, 23 May 2024 - 20:25 -

Municipality

MunicipalityTax Burden in Piteå Municipality Piteå Municipality, located in Norrbotten County, is known for i

Thu, 23 May 2024 - 20:24 - Show more ->