Municipality

- Articles

- Municipality

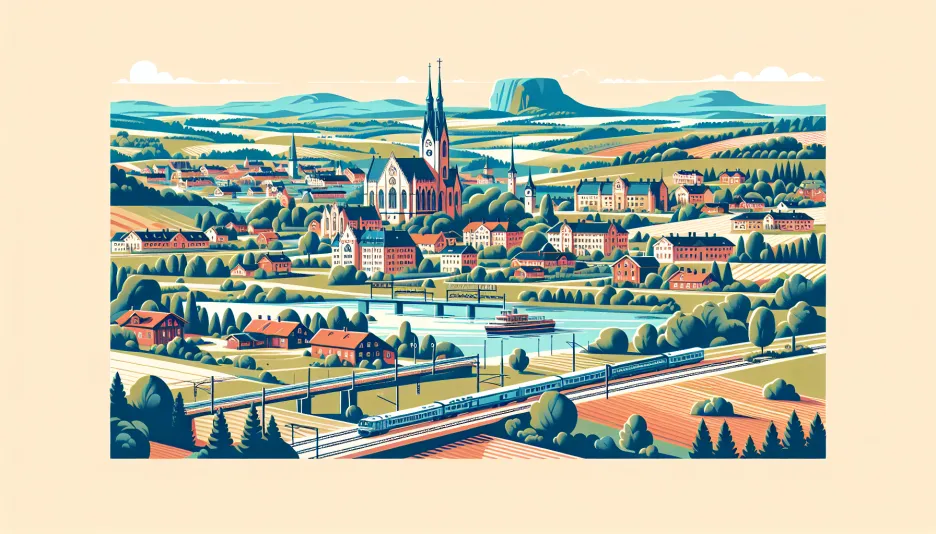

Tax Burden in Skara Municipality

Skara Municipality is one of Sweden's many municipalities where residents contribute to the common welfare through municipal taxes. Currently, the municipal tax rate in Skara is 21.9%, while the county council tax is 11.48%. In addition, there is a burial fee of 0.28%. For those who are members of the Swedish Church, there is also a church fee of 1.35%. The total tax burden excluding the church fee thus amounts to 33.38%.

Use of Tax Revenues

The tax revenues collected by the municipality are used to finance a variety of services and activities that benefit residents. These include education, elderly care, social services, infrastructure, and culture. A significant portion of the municipality's budget goes towards ensuring that children and young people receive a good education, which includes everything from preschool to high school. Elderly care is also an important area that encompasses both home care and special housing for the elderly.

Economic Challenges and Opportunities

Skara Municipality faces several economic challenges. An aging population means increased costs for elderly care, while the need to invest in schools and infrastructure remains. Additionally, external factors such as state grants and economic cycles impact the municipality's budget.

Despite these challenges, there are also opportunities. Skara has a strong cultural and historical profile that can attract tourists and new residents. By investing in sustainable development and innovation, the municipality can create new jobs and improve the economic situation in the long run.

Standard of Living and Quality

The standard of living in Skara is generally good. The municipality offers high-quality services, contributing to a good quality of life for its residents. Education maintains a high standard, and there is a wide range of recreational activities and cultural events. Additionally, housing prices are relatively low compared to larger cities, making it attractive for families to settle here.

Impact on Individuals' Finances

The tax burden in Skara means that a significant portion of residents' income goes towards taxes. For an individual who is not a member of the Swedish Church, the total tax is 33.38%. This affects how much money remains in the wallet after taxes. To get a clear picture of the net salary one receives, individuals can use our tax calculator, which helps calculate the net salary based on the gross salary provided.

For many residents, the high tax burden means being careful with their personal finances. At the same time, they receive a lot in return in the form of welfare services such as education, healthcare, and social services. It is a balancing act between paying taxes and accessing the services that taxes finance.

Sweden's national debt

-

Municipality

MunicipalityTax Pressure in Kiruna Municipality - An Overview of Tax Rates and Economic Challenges

Thu, 23 May 2024 - 22:26

-

Municipality

MunicipalityTax Pressure in Kiruna Municipality Kiruna Municipality, located in the northernmost part of Swede

Thu, 23 May 2024 - 20:26 -

Municipality

MunicipalityTax Burden in Haparanda Municipality Haparanda municipality, located on the border with Finland, is

Thu, 23 May 2024 - 20:25 -

Municipality

MunicipalityTax Burden in Boden Municipality Boden Municipality is located in Norrbotten County and is known f

Thu, 23 May 2024 - 20:25 -

Municipality

MunicipalityTax Burden in Piteå Municipality Piteå Municipality, located in Norrbotten County, is known for i

Thu, 23 May 2024 - 20:24 - Show more ->