Municipality

- Articles

- Municipality

Tax Burden in Vänersborg Municipality

Vänersborg Municipality is one of the many Swedish municipalities where residents contribute to the common welfare through municipal taxes. Currently, the municipal tax rate in Vänersborg is 22.21%, with a county tax of 11.48% and a burial fee of 0.28%. Additionally, members of the Swedish Church pay a church fee of 1.35%. The total tax burden excluding the church fee is thus 33.69%.

Use of Tax Revenues

The tax revenues collected by the municipality are used for a variety of purposes aimed at improving the quality of life for residents. A significant portion of the budget goes towards education, healthcare, and infrastructure. Schools in Vänersborg receive substantial resources to ensure a high standard of education, and elderly care also receives a large share of the budget to provide quality care and services to the municipality's elderly residents.

Economic Challenges and Opportunities

Vänersborg Municipality faces several economic challenges. An aging population means increased costs for healthcare, while maintaining a high standard of education with limited resources may become more difficult. Additionally, global economic conditions and national political decisions impact the municipality's economic situation.

Despite these challenges, there are also several opportunities. The municipality has the potential to attract new residents and businesses by offering a high quality of life and good transportation connections. Investments in infrastructure and housing construction can also contribute to economic growth and an expanded tax base.

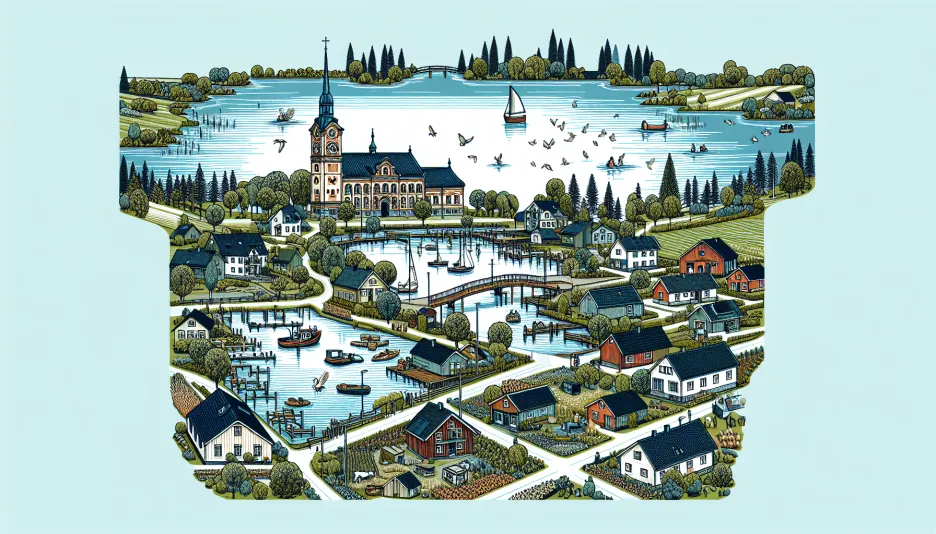

Standard of Living and Quality

The standard of living in Vänersborg is generally high. The municipality offers a wide range of recreational activities, cultural events, and scenic areas. Schools maintain a good quality, and healthcare and social services are well-developed. At the same time, housing prices are relatively affordable compared to larger cities, making it attractive for families and retirees to settle here.

Effects on Individuals' Finances

The tax burden in Vänersborg means that a significant portion of residents' incomes goes towards taxes. For a person who is not a member of the Swedish Church, this translates to 33.69% of the gross salary being paid in taxes. Members of the Swedish Church pay an additional 1.35%, resulting in a total tax burden of 35.04%. This affects how much money remains in the wallet after taxes.

To get a better idea of how much net salary one takes home after taxes, individuals can use our tax calculator. This tool can help residents plan their finances and understand how the tax burden impacts their disposable income.

In conclusion, Vänersborg Municipality is a place with a high quality of life and good public services, but with a tax burden that affects residents' finances. By effectively utilizing tax revenues and addressing economic challenges, the municipality can continue to be an attractive place to live and work in.

Sweden's national debt

-

Municipality

MunicipalityTax Pressure in Kiruna Municipality - An Overview of Tax Rates and Economic Challenges

Thu, 23 May 2024 - 22:26

-

Municipality

MunicipalityTax Pressure in Kiruna Municipality Kiruna Municipality, located in the northernmost part of Swede

Thu, 23 May 2024 - 20:26 -

Municipality

MunicipalityTax Burden in Haparanda Municipality Haparanda municipality, located on the border with Finland, is

Thu, 23 May 2024 - 20:25 -

Municipality

MunicipalityTax Burden in Boden Municipality Boden Municipality is located in Norrbotten County and is known f

Thu, 23 May 2024 - 20:25 -

Municipality

MunicipalityTax Burden in Piteå Municipality Piteå Municipality, located in Norrbotten County, is known for i

Thu, 23 May 2024 - 20:24 - Show more ->