Municipality

- Articles

- Municipality

Tax Burden in Lysekil Municipality

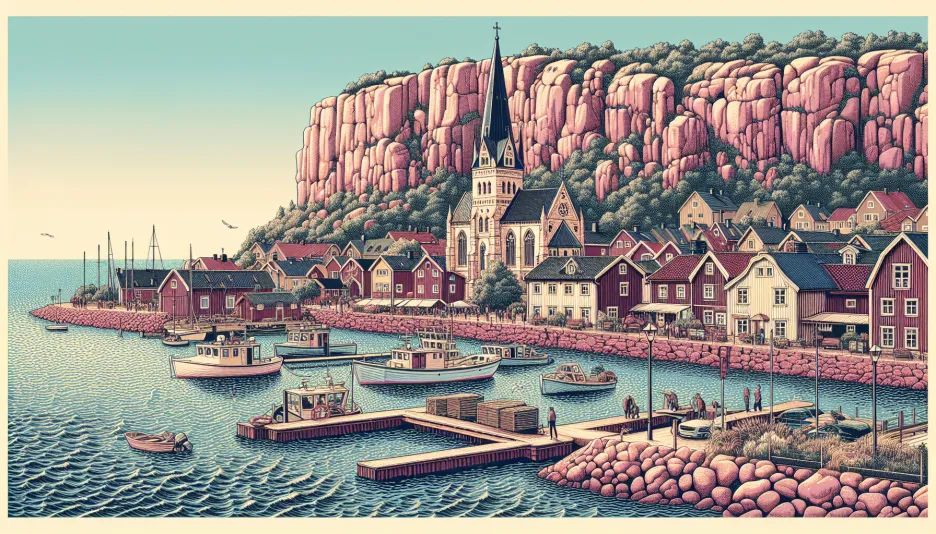

Lysekil municipality, located along the beautiful Bohuslän coast, is known for its scenic environment and rich maritime culture. But what does the tax burden look like for the residents in this municipality, and how are tax revenues utilized? Let's delve deeper into this topic.

Municipal Tax and Other Taxes

The tax rate in Lysekil municipality consists of several components:

- Municipal tax: 22.46%

- County council tax: 11.48%

- Funeral fee: 0.28%

- Church fee (for members of the Swedish Church): 1.35%

The total tax burden for residents in Lysekil, excluding the church fee, is 33.94%. For members of the Swedish Church, the total tax burden becomes 35.29%.

Utilization of Tax Revenues

Tax revenues in Lysekil municipality are used to finance a range of essential services and functions that contribute to the well-being and quality of life of residents. Some of the primary areas of utilization include:

- Education: Funding for primary schools, high schools, and adult education.

- Healthcare and social services: Elderly care, home care services, and support for individuals with disabilities.

- Infrastructure: Maintenance and development of roads, parks, and public buildings.

- Culture and leisure: Libraries, sports facilities, and cultural events.

Economic Challenges and Opportunities

Lysekil municipality faces several economic challenges. An aging population entails increased costs for healthcare and social services, while the need to invest in infrastructure and education remains. The municipality also grapples with attracting and retaining young families and workforce, which are crucial for long-term economic growth.

At the same time, there are opportunities. Lysekil's strategic coastal location and proximity to Gothenburg make it attractive for tourism and maritime industries. Investments in sustainable energy and environmental technology can also create new jobs and economic growth.

Standard of Living and Quality

The standard of living in Lysekil is generally high. The municipality offers a secure and scenic environment with good access to services and recreational activities. Schools maintain high quality, and healthcare is well-developed. However, the high tax burden may impact individuals' finances, potentially resulting in some households having less disposable income after taxes.

Effects on Individuals' Finances

The high tax burden in Lysekil means that residents contribute a significant portion of their income in taxes. This can affect households' purchasing power and savings. To gain a better understanding of how much is left in the wallet after taxes, one can use our tax calculator, which computes the net salary based on the specified gross salary.

In conclusion, Lysekil offers a high quality of life despite a relatively high tax burden. By continuing to invest in essential societal functions and exploring new economic opportunities, the municipality can ensure a sustainable and attractive future for its residents.

Sweden's national debt

-

Municipality

MunicipalityTax Pressure in Kiruna Municipality - An Overview of Tax Rates and Economic Challenges

Thu, 23 May 2024 - 22:26

-

Municipality

MunicipalityTax Pressure in Kiruna Municipality Kiruna Municipality, located in the northernmost part of Swede

Thu, 23 May 2024 - 20:26 -

Municipality

MunicipalityTax Burden in Haparanda Municipality Haparanda municipality, located on the border with Finland, is

Thu, 23 May 2024 - 20:25 -

Municipality

MunicipalityTax Burden in Boden Municipality Boden Municipality is located in Norrbotten County and is known f

Thu, 23 May 2024 - 20:25 -

Municipality

MunicipalityTax Burden in Piteå Municipality Piteå Municipality, located in Norrbotten County, is known for i

Thu, 23 May 2024 - 20:24 - Show more ->