Municipality

- Articles

- Municipality

Tax Burden in Hultsfred Municipality

Hultsfred Municipality, located in Småland, has a total municipal tax rate of 33.77% excluding the church fee. This tax rate consists of a municipal tax of 21.91%, county council tax of 11.86%, and a burial fee of 0.28%. For members of the Swedish Church, an additional church fee of 1.52% applies, making the total tax burden for these individuals 35.29%.

Use of Tax Revenues

Tax revenues in Hultsfred Municipality are used to finance a range of important societal functions and services. These include education, healthcare, infrastructure, culture and leisure, as well as social services. A significant portion of the budget goes to schools and preschools to ensure a high standard of education for the municipality's children and youth. Healthcare and social care are also priorities, with resources directed towards elderly care and support for individuals with disabilities.

Economic Challenges and Opportunities

Hultsfred Municipality faces several economic challenges. An aging population entails increased costs for healthcare and social care, while a declining population may lead to lower tax revenues. Furthermore, investments in infrastructure and housing are needed to meet future needs and attract new residents.

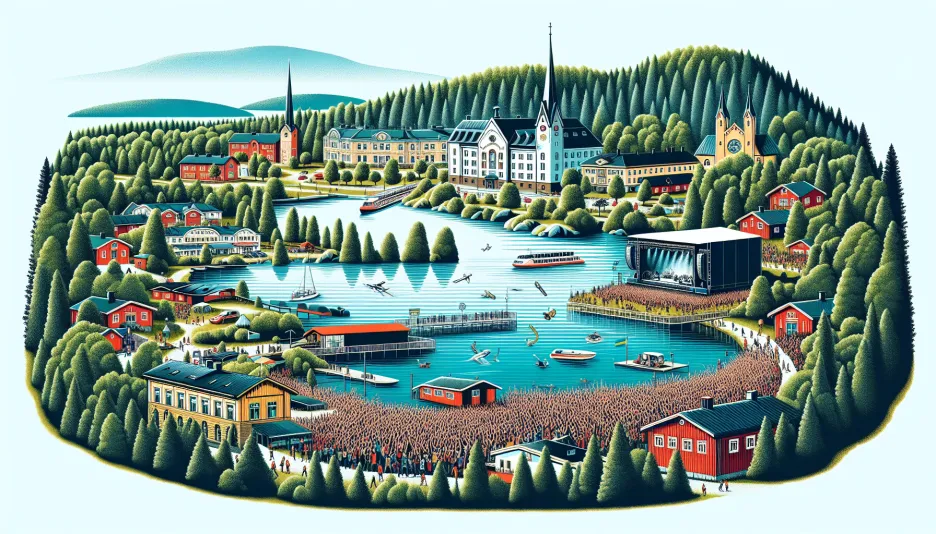

At the same time, there are also opportunities. Hultsfred has a strong tradition in music and culture, which can be leveraged to promote the municipality and attract tourists and new residents. Additionally, there is potential to develop the business sector and create new job opportunities, especially within small and medium-sized enterprises.

Standard of Living and Quality in the Municipality

The standard of living in Hultsfred is generally good, with access to quality schools, healthcare, and a rich cultural life. The municipality offers a scenic environment with many opportunities for outdoor activities and recreation. The quality of municipal services is high, contributing to a good quality of life for residents.

Effects on Individuals' Finances

The tax burden in Hultsfred Municipality naturally affects individuals' finances. With a total tax rate of 33.77% excluding the church fee, a significant portion of residents' incomes will go towards taxes. This may result in less disposable income for consumption and savings. For members of the Swedish Church who pay the church fee, the tax burden is even higher.

To get a clearer picture of how much will remain of your salary after tax, you can use our tax calculator. This tool helps you calculate your net salary based on your gross salary and provides a better understanding of your financial situation.

In summary, Hultsfred Municipality offers a good standard of living and high quality of municipal services, but also faces economic challenges that require strategic investments and development to ensure a sustainable future.

Sweden's national debt

-

Municipality

MunicipalityTax Pressure in Kiruna Municipality - An Overview of Tax Rates and Economic Challenges

Thu, 23 May 2024 - 22:26

-

Municipality

MunicipalityTax Pressure in Kiruna Municipality Kiruna Municipality, located in the northernmost part of Swede

Thu, 23 May 2024 - 20:26 -

Municipality

MunicipalityTax Burden in Haparanda Municipality Haparanda municipality, located on the border with Finland, is

Thu, 23 May 2024 - 20:25 -

Municipality

MunicipalityTax Burden in Boden Municipality Boden Municipality is located in Norrbotten County and is known f

Thu, 23 May 2024 - 20:25 -

Municipality

MunicipalityTax Burden in Piteå Municipality Piteå Municipality, located in Norrbotten County, is known for i

Thu, 23 May 2024 - 20:24 - Show more ->